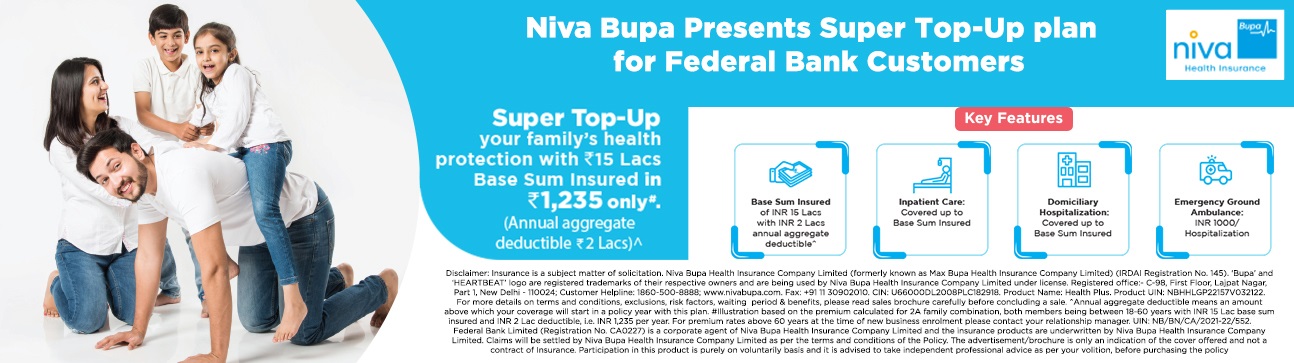

Federal Bank with Niva Bupa bring you the best-in-class Super top up plan which offers coverage upto Rs 15 Lakh with Rs 2 Lakh of deductible. The plan comes with host of benefits like hospitalisation, day care treatments, organ transplant expenses, domiciliary hospitalisation among other benefits. You don’t have to look any further to secure your, and your family’s healthcare expenses!

Inpatient Care

We cover cost of medical treatment when you or your insured family members are hospitalised for treatment.

Hospital Accommodation

While hospitalised, you can choose to opt for a Single Private Room. ICU charges are covered up to Sum Insured.

Day Care Treatment

We cover 536 day care treatments under this plan. Please refer to the policy document to know the entire list of day care procedures covered under the product.

Pre and Post hospitalisation medical expenses

We reimburse pre & post hospitalisation medical expenses incurred due to illness/injury. The period of the treatment covered is 30 days before you get admitted to the hospital and 60 days after you get discharged from the hospital. This is subject to Niva Bupa accepting the In-patient Care hospitalisation, Day Care or Domiciliary hospitalisation claim.

Domiciliary Hospitalisation

In case a bed in the hospital is unavailable or on advice of the attending medical practitioner, treatment is administered at home; we pay for medical treatment taken at home, which would otherwise have required hospitalisation. Such treatment should continue for at least 3 consecutive days and confirmation from treating medical practitioner/insured that insured person could not be transferred to the hospital or hospital bed was unavailable, as the case may be.

Organ Transplant

Medical expenses for an organ donor’s inpatient treatment for the harvesting of the organ donated is also covered provided the organ is for the use of the insured person.

Road Ambulance Cover

We also cover the road ambulance expenses to transfer the insured following an emergency to the nearest hospital. We also provide ambulance coverage if the medical condition requires immediate ambulance services from the existing Hospital to another Hospital with advanced facilities for management of the current Hospitalisation.These expenses are paid up to INR 1,000 if we have accepted the In-patient claim.

Annual Aggregate Deductible

There is an annual aggregate deductible in the plan of Rs 2 Lakhs. This means that we will pay the medical expenses of hospitalisation deducting the initial Rs 2 Lakh from it. Please note that the maximum we pay is Rs 15 Lakh.