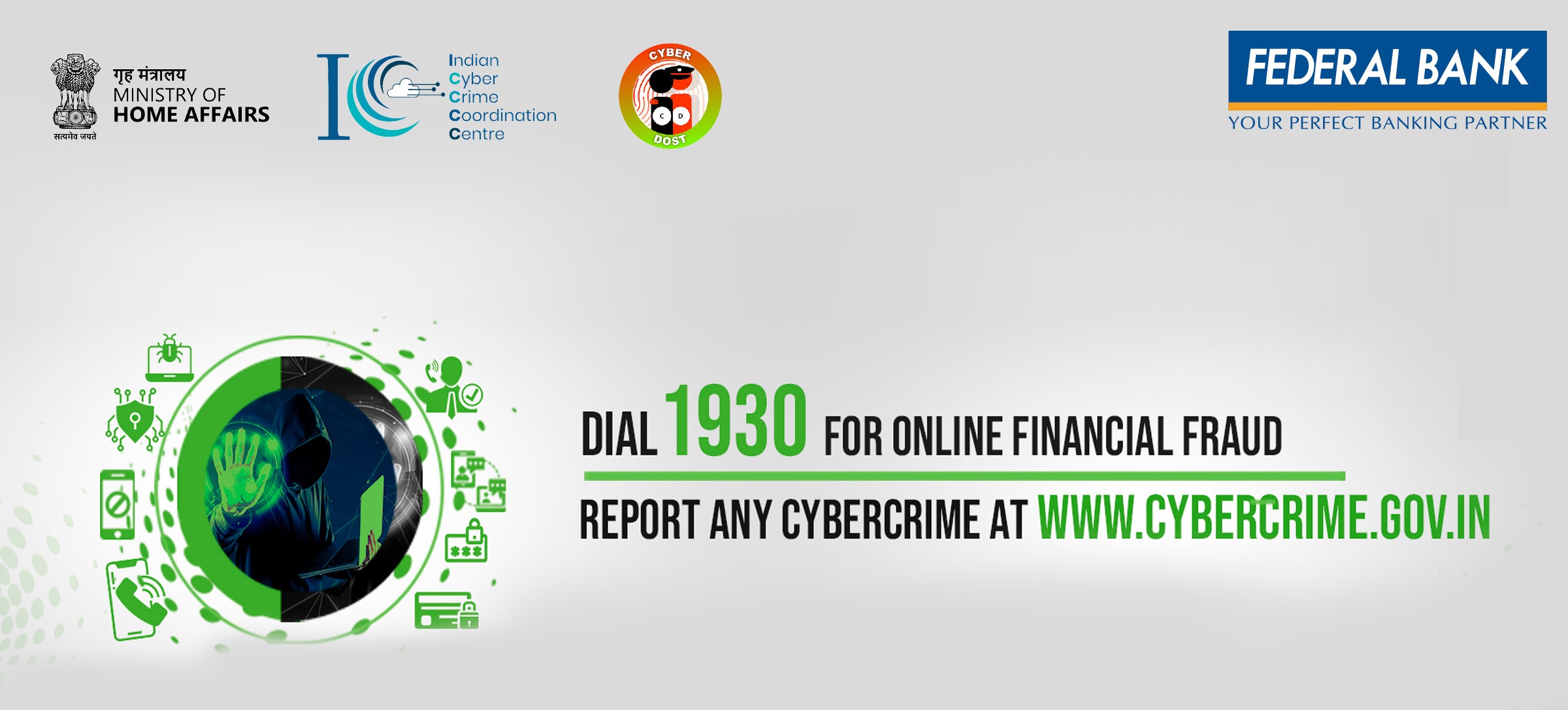

Stay Informed, Stay Smart

Our Solutions for Your Banking Needs

Apply for Credit Card

Live it up with the new three feature-rich Credit Cards from Federal Bank. Experience the finest class of living with our Credit Cards.

Know More

Apply for Personal Loan

Enjoy instant access to money with minimal paperwork and flexible repayment options. Perfect for urgent needs or planned expenses.

Know More

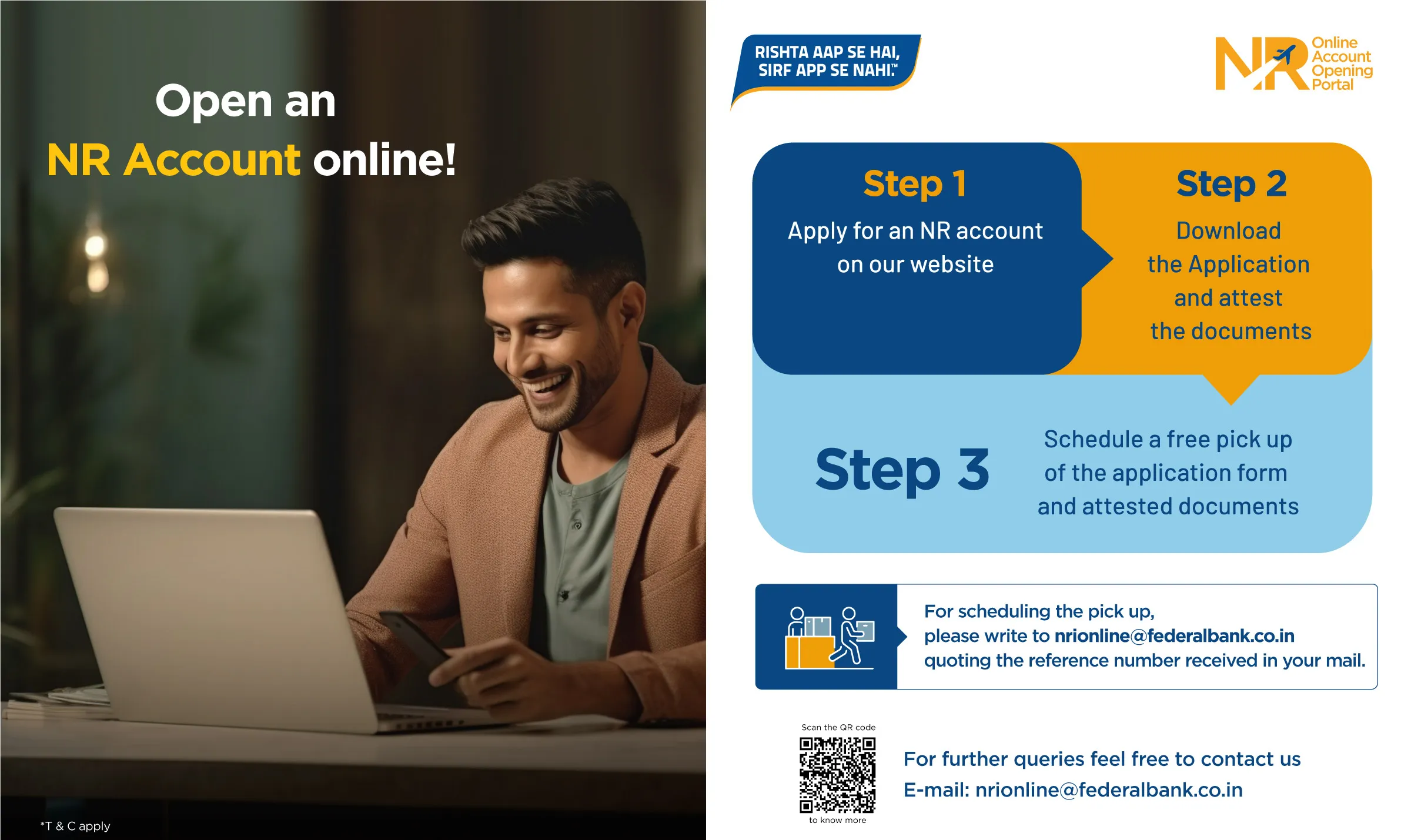

Open an Account

Federal Bank has a wide range of savings accounts with smart features. Open your preferred savings account in just 3 minutes over a video call

Know More

Register for Fednet

No queues, No waiting - Register for Internet Banking facility right away. With 24x7 Banking, bank anytime from just about

Know More

Download FedMobile

Enriched with new banking and payment features, FedMobile is a complete mobile banking solution, which enables you to access and manage your accounts from anywhere, anytime.

Know More

Protect your Valuables

Our Safe Deposit Locker services offer you a private and protected space to store your important documents, jewellery, and other cherished items.

Know MoreYou might be interested

Recommendations for a safe and easy banking experience

Blog

Stay connected with the evolving landscape of banking innovations, enabling you to make intelligent financial decisions.

Learn More

Tutorial Videos

Immerse yourself in the nuances of banking with our tutorial video hub, providing step-by-step guidance on a wide array of products and services.

Learn More

Safe Zindagi

Your go-to source for secure banking guidelines and a comprehensive understanding of the vast array of products and services in the banking sector.

Learn More