Investor Charter

- Vision

Towards making Indian Securities Market - Transparent, Efficient, & Investor friendly by providing safe, reliable, transparent and trusted record keeping platform for investors to hold and transfer securities in dematerialized form.

- Mission

- To hold securities of investors in dematerialised form and facilitate its transfer, while ensuring safekeeping of securities and protecting interest of investors.

- To provide timely and accurate information to investors with regard to their holding and transfer of securities held by them.

- To provide the highest standards of investor education, investor awareness and timely services so as to enhance Investor Protection and create awareness about Investor Rights.

- Details of business transacted by the Depository and Depository Participant (DP)

A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants - Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available on the links:

NSDL- https://nsdl.co.in/dpsch.php

CDSL- https://www.cdslindia.com/DP/dplist.aspx

- Description of services provided by the Depository through Depository Participants (DP) to investors

|

Sr. no.

|

Brief about the Activity / Service

|

Expected Timelines for processing by the DP after receipt of proper documents

|

|

1

|

Dematerialization of securities

|

7 days

|

|

2

|

Rematerialization of securities

|

7 days

|

|

3

|

Mutual Fund Conversion / Destatementization

|

5 days

|

|

4

|

Re-conversion /

Restatementisation of Mutual

fund units

|

7 days

|

|

5

|

Transmission of securities

|

7 days

|

|

6

|

Registering pledge request

|

15 days

|

|

7

|

Closure of demat account

|

30 days

|

|

8

|

Settlement Instruction

|

For T+1-day settlements, Participants

shall accept instructions from the Clients, in physical form up to 4 p.m. (in case of electronic instructions up to 6.00 p.m.) on T Day for pay-in of securities.

For T+0-day settlements, Participants shall accept EPI instructions from the clients, till 11:00 AM on T day.

Note: ‘T’ refers ‘Trade Day’

|

(2) Depositories provide special services like pledge, hypothecation, and internet based services etc. in addition to their core services and these include

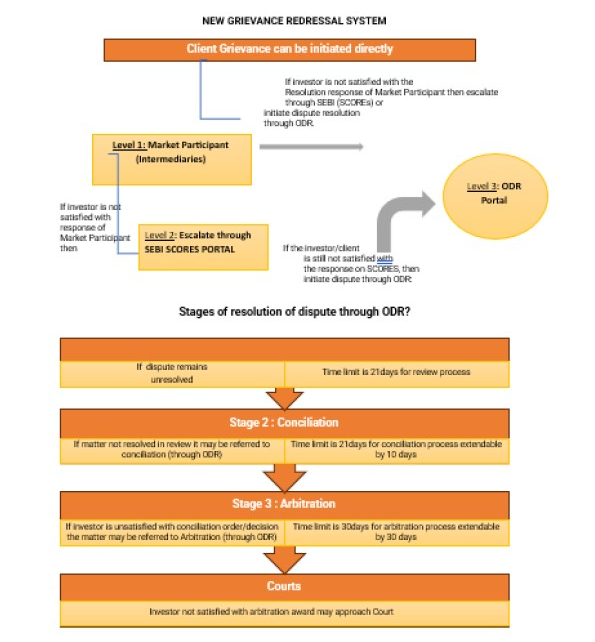

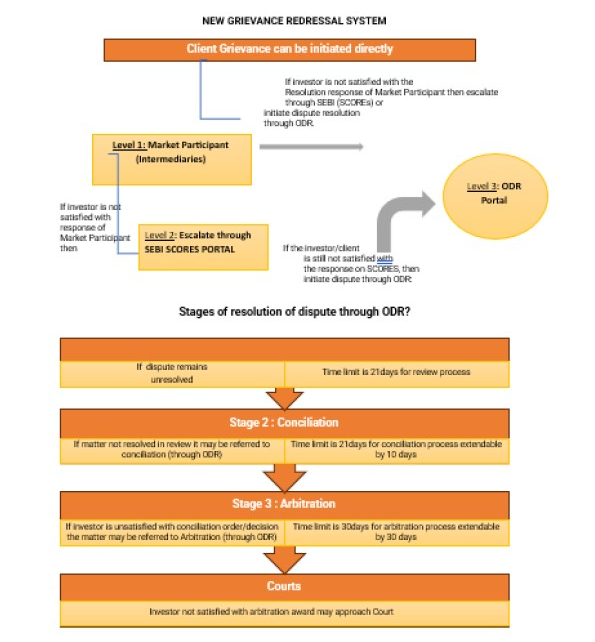

- Details of Grievance Redressal Mechanism

(1) The Process of investor grievance redressal

|

1

|

Investor Complaint/ Grievances

|

Investor can lodge complaint/ grievance against the Depository/DP in the following ways:

a. Electronic mode

1. SCORES 2.0 (a web based centralized grievance redressal system of SEBI) [https://scores.sebi.gov.in/]

Two Level Review for complaint/grievance against DP:

First review done by Designated Body

Second review done by SEBI

2. Respective Depository’s web portal dedicated for the filing of compliant:

NSDL- https://investor.nsdl.com/portal/en/home

CDSL- https://www.cdslindia.com/Footer/grievances.aspx

Emails to designated email IDs of Depository Emails to designated email IDs of Depository:

NSDL - relations@nsdl.co.in

CDSL - complaints@cdslindia.com

b. Offline mode

The complaint can be lodged at the nearest Branch offices. Click here to download the form.

The complaints/ grievances lodged directly with the Depository shall be resolved within 21 days.

|

|

2

|

Online Dispute Resolution (ODR) platform for online Conciliation and Arbitration

|

If the Investor is not satisfied with the resolution provided by DP or other Market Participants, then the Investor has the option to file the complaint/ grievance on SMARTODR platform for its resolution through by online conciliation or arbitration.

SMARTODR link - https://smartodr.in/login

|

|

3

|

Steps to be followed in ODR for Review, Conciliation and

Arbitration

|

- Investor to approach Market Participant for redressal of complaint

- If investor is not satisfied with response of Market Participant, he/she can escalate the complaint on SEBI SCORES portal.

- Alternatively, the investor may also file a complaint on SMARTODR portal for its resolution through online conciliation and arbitration.

- Upon receipt of complaint on SMARTODR portal, the relevant MII will review the matter and endeavour to resolve the matter between the Market Participant and investor within 21 days.

- If the matter could not be amicably resolved, then the Investor may request the MII to refer the matter case for conciliation.

- During the conciliation process, the conciliator will endeavor for amicable settlement of the dispute within 21 days, which may be extended with 10 days by the conciliator.

- If the conciliation is unsuccessful, then the investor may request to refer the matter for arbitration.

- The arbitration process to be concluded by arbitrator(s) within 30 days, which is extendable by 30 days.

|

llustration of New Grievance Redressal System:

Flow-chart of New Grievance Redressal System

- Guidance pertaining to special circumstances related to market activities: Termination of the Depository Participant

|

Sr. No.

|

Type of special circumstances

|

Timelines for the Activity/ Service

|

|

1

|

i) Depositories to terminate the participation in case a participant no longer meets the eligibility criteria and/or any other grounds as mentioned in the bye laws like suspension of trading member by the Stock Exchanges.

ii) Participant surrenders the participation by its own wish.

|

Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email.

|

- Dos and Don’ts for Investors

- Rights of investors

- Responsibilities of Investors

- Code of Conduct for Depositories (Part D of Third Schedule of SEBI (D & P) regulations, 2018)

- Code of Conduct for Participants (Part A of Third Schedule of SEBI (D & P) regulations, 2018)

Investor Complaints Data

Data for every month ending March 2025

|

SN

|

Received from

|

Carried forward from previous month

|

Received during the month

|

Total Pending

|

Resolved

|

Pending at the end of the month

|

Average Resolution time (in days)

|

| |

Pending for less than 3 months

|

Pending for more than 3 months

|

|

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

|

1

|

Directly from Investors

|

0

|

0

|

0

|

0

|

0

|

0

|

-

|

|

2

|

SEBI (SCORES)

|

0

|

0

|

0

|

0

|

0

|

0

|

-

|

|

3

|

Stock Exchanges (if relevant)

|

0

|

0

|

0

|

0

|

0

|

0

|

-

|

|

4

|

Other Sources (if any)

|

0

|

1

|

0

|

1

|

0

|

0

|

-

|

|

Grand Total

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

Trend of Monthly disposal of complaints for the Financial Year

|

SN

|

Month

|

Carried forward from previous month

|

Received during the month

|

Resolved during the month

|

Pending at the end of the month

|

| 1 |

April 2024 |

0 |

0 |

0 |

0 |

| 2 |

May 2024 |

0 |

0 |

0 |

0 |

| 3 |

June 2024 |

0 |

0 |

0 |

0 |

| 4 |

July 2024 |

0 |

0 |

0 |

0 |

| 5 |

August 2024 |

0 |

2 |

2 |

0 |

| 6 |

September 2024 |

0 |

2 |

2 |

0 |

| 7 |

October 2024 |

0 |

1 |

1 |

0 |

| 8 |

November 2024 |

0 |

0 |

0 |

0 |

| 9 |

December 2024 |

0 |

1 |

1 |

0 |

| 10 |

January 2025 |

0 |

0 |

0 |

0 |

| 11 |

February 2025 |

0 |

3 |

3 |

0 |

| 11 |

March 2025 |

0 |

0 |

0 |

0 |

|

Grand Total

|

0

|

9

|

9

|

0

|

Trend of annual disposal of complaints

|

SN

|

Year

|

Carried forward from previous year

|

Received during the year

|

Resolved during the year

|

Pending at the end of the year

|

|

1

|

2017-18

|

0

|

1

|

1

|

0

|

|

2

|

2018-19

|

0

|

1

|

1

|

0

|

|

3

|

2019-20

|

0

|

1

|

1

|

0

|

|

4

|

2020-21

|

0

|

1

|

1

|

0

|

|

5

|

2021-22

|

0

|

4

|

4

|

0

|

|

6

|

2022-23

|

0

|

2

|

2

|

0

|

| 7 |

2023-24 |

0 |

8 |

8 |

0 |

| 8 |

2024-25 |

0 |

9 |

9 |

0 |

|

Grand Total

|

0

|

27

|

27

|

0

|

INFORMATION CONTAINED IN LINKS TO THE INVESTOR CHARTER

Basic Services Demat Account (BSDA)

The facility of BSDA with limited services for eligible individuals was introduced with the objective of achieving wider financial inclusion and to encourage holding of demat accounts. As per the SEBI direction, No Annual Maintenance (AMC) shall be levied, if the value of securities holding in the Demat Account (Debt as well as other than debt securities combined) is up to Rs. 4 lakhs. For value of securities holdings in Demat Account (Debt as well as other than debt securities combined) is more than Rs 4 lakhs but up to Rs 10 lakhs, AMC not exceeding Rs 100 is chargeable.

Transposition cum dematerialization

In case of transposition-cum- dematerialisation, client can get securities dematerialised in the same account if the names appearing on the certificates match with the names in which the account has been opened but are in a different order. The same may be done by submitting the security certificates along with the Transposition Form and Demat Request Form.

Linkages with Clearing System

for actual delivery of securities to the clearing system from the selling brokers and delivery of securities from the clearing system to the buying broker.

E-account opening

Account opening through digital mode, popularly known as “On-line Account opening”, wherein investor intending to open the demat account can visit DP website, fill in the required information, submit the required documents, conduct video IPV and demat account gets opened without visiting DPs office.

Online instructions for execution

internet-enabled services like Speed-e (NSDL) & Easiest (CDSL) empower a demat account holder in managing his/her securities ‘anytime-anywhere’ in an efficient and convenient manner and submit instructions online without the need to use paper. These facilities allows Beneficial Owner (BO) to submit transfer instructions and pledge instructions including margin pledge from their demat account. The instruction facilities are also available on mobile applications through android, windows and IOS platforms.

e-DIS / Demat Gateway

Investors can give instructions for transfer of securities through e-DIS apart from physical DIS. Here, for on-market transfer of securities, investors need to provide settlement number along with the ISIN and quantity of securities being authorized for transfer. Client shall be required to authorize each e-DIS valid for a single settlement number / settlement date, by way of OTP and PIN/password, both generated at Depositories end. Depositories are adopting necessary risk containment measures in this regard.

e-CAS facility

Consolidated Account Statements are available online and could also be accessed through mobile app to facilitate the investors to view their holdings in demat form.

Miscellaneous services

Transaction alerts through SMS, e-locker facilities, chat bots for instantaneously responding to investor queries etc. have also been developed.

Flow-chart of New Grievance Redressal System

Dos and Don’ts for Investor

|

Sl No.

|

Guidance

|

|

1.

|

Always deal with a SEBI registered Depository Participant for opening a demat account.

|

|

2.

|

Read all the documents carefully before signing them.

|

|

3.

|

Before granting Power of attorney to operate your demat account to an intermediary like Stock Broker, Portfolio Management Services (PMS) etc., carefully examine the scope and implications of powers being granted.

|

|

4.

|

Always make payments to registered intermediary using banking channels.

No payment should be made in name of employee of intermediary.

|

|

5.

|

Accept the Delivery Instruction Slip (DIS) book from your DP only (pre- printed with a serial number along with your Client ID) and keep it in safe custody and do not sign or issue blank or partially filled DIS slips.

Always mention the details like ISIN, number of securities accurately. In case of any queries, please contact your DP or broker and it should be signed by all demat account holders.

Strike out any blank space on the slip and Cancellations or corrections on the DIS should be initialed or signed by all the account holder(s).

Do not leave your instruction slip book with anyone else.

Do not sign blank DIS as it is equivalent to a bearer cheque.

|

|

6.

|

Inform any change in your Personal Information (for example address or Bank Account details, email ID, Mobile number) linked to your demat account in the prescribed format and obtain confirmation of updation in system.

|

|

7.

|

Mention your Mobile Number and email ID in account opening form to receive SMS alerts and regular updates directly from depository.

|

|

8.

|

Always ensure that the mobile number and email ID linked to your demat account are the same as provided at the time of account opening/updation.

|

|

9.

|

Do not share password of your online trading and demat account with anyone.

|

|

10.

|

Do not share One Time Password (OTP) received from banks, brokers, etc.

These are meant to be used by you only.

|

|

11.

|

Do not share login credentials of e-facilities provided by the depositories such as e-DIS/demat gateway, SPEED-e/easiest etc. with anyone else.

|

|

12.

|

Demat is mandatory for any transfer of securities of Listed public limited companies with few exceptions.

|

|

13.

|

If you have any grievance in respect of your demat account, please write to

designated email IDs of depositories or you may lodge the same with SEBI online at https://scores.gov.in/scores/Welcome.html

|

|

14.

|

Keep a record of documents signed, DIS issued and account statements received.

|

|

15.

|

As Investors, you are required to verify the transaction statement carefully for all debits and credits in your account. In case of any unauthorized debit or credit, inform the DP or your respective Depository.

|

|

16.

|

Appoint a nominee to facilitate your heirs in obtaining the securities in your demat account, on completion of the necessary procedures.

|

|

17.

|

Register for Depository's internet-based facility or download mobile app of the depository to monitor your holdings.

|

|

18.

|

Ensure that, both, your holding and transaction statements are received periodically as instructed to your DP.

You are entitled to receive a transaction statement every month if you have any transactions.

|

|

19.

|

Do not follow herd mentality for investments. Seek expert and professional advice for your investments

|

|

20.

|

Beware of assured/fixed returns.

|

Rights of investors

- Receive a copy of KYC, copy of account opening documents.

- No minimum balance is required to be maintained in a demat account.

- No charges are payable for opening of demat accounts.

- If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. You have the right to revoke any authorization given at any time.

- You can open more than one demat account in the same name with single DP/ multiple DPs.

- Receive statement of accounts periodically. In case of any discrepancies in statements, take up the same with the DP immediately. If the DP does not respond, take up the matter with the Depositories.

- Pledge and /or any other interest or encumbrance can be created on demat holdings.

- Right to give standing instructions with regard to the crediting of securities in demat account.

- Investor can exercise its right to freeze/defreeze his/her demat account or specific securities / specific quantity of securities in the account, maintained with the DP.

- In case of any grievances, Investor has right to approach Participant or Depository or SEBI for getting the same resolved within prescribed timelines.

- Every eligible investor shareholder has a right to cast its vote on various resolutions proposed by the companies for which Depositories have developed an internet based ‘e-Voting’ platform.

- Receive information about charges and fees. Any charges/tariff agreed upon shall not increase unless a notice in writing of not less than thirty days is given to the Investor.

- Right to indemnification for any loss caused due to the negligence of the Depository or the participant.

- Right to opt out of the Depository system in respect of any security.

Responsibilities of Investors

- Deal with a SEBI registered DP for opening demat account, KYC and Depository activities.

- Provide complete documents for account opening and KYC (Know Your Client). Fill all the required details in Account Opening Form / KYC form in own handwriting and cancel out the blanks.

- Read all documents and conditions being agreed before signing the account opening form.

- Accept the Delivery Instruction Slip (DIS) book from DP only (preprinted with a serial number along with client ID) and keep it in safe custody and do not sign or issue blank or partially filled DIS.

- Always mention the details like ISIN, number of securities accurately.

- Inform any change in information linked to demat account and obtain confirmation of updation in the system.

- Regularly verify balances and demat statement and reconcile with trades / transactions.

- Appoint nominee(s) to facilitate heirs in obtaining the securities in their demat account.

- Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits.

Code of Conduct for Depositories (Part D of Third Schedule of SEBI (D & P) regulations, 2018)

A Depository shall:

- Always abide by the provisions of the Act, Depositories Act, 1996, any Rules or Regulations framed thereunder, circulars, guidelines and any other directions issued by the Board from time to time.

- Adopt appropriate due diligence measures.

- Take effective measures to ensure implementation of proper risk management framework and good governance practices.

- Take appropriate measures towards investor protection and education of investors.

- Treat all its applicants/members in a fair and transparent manner.

- promptly inform the Board of violations of the provisions of the Act, the Depositories Act, 1996, rules, regulations, circulars, guidelines or any other directions by any of its issuer or issuer’s agent.

- Take a proactive and responsible attitude towards safeguarding the interests of investors, integrity of depository’s systems and the securities market.

- Endeavor for introduction of best business practices amongst itself and its members.

- Act in utmost good faith and shall avoid conflict of interest in the conduct of its functions.

- Not indulge in unfair competition, which is likely to harm the interests of any other Depository, their participants or investors or is likely to place them in a disadvantageous position while competing for or executing any assignment.

- Segregate roles and responsibilities of key management personnel within the depository including

a. Clearly mapping legal and regulatory duties to the concerned position

b. Defining delegation of powers to each position

c. Assigning regulatory, risk management and compliance aspects to business and support teams

- Be responsible for the acts or omissions of its employees in respect of the conduct of its business.

- Monitor the compliance of the rules and regulations by the participants and shall further ensure that their conduct is in a manner that will safeguard the interest of investors and the securities market.

Code of Conduct for Participants (Part A of Third Schedule of SEBI (D & P) regulations, 2018)

- A participant shall make all efforts to protect the interests of investors.

- A participant shall always endeavour to—

1. Render the best possible advice to the clients having regard to the client’s needs and the environments and his own professional skills.

2. Ensure that all professional dealings are effected in a prompt, effective and efficient manner.

3. Inquiries from investors are adequately dealt with.

4. Grievances of investors are redressed without any delay.

- A participant shall maintain high standards of integrity in all its dealings with its clients and other intermediaries, in the conduct of its business.

- A participant shall be prompt and diligent in opening of a beneficial owner account, dispatch of the dematerialisation request form, rematerialisation request form and execution of debit instruction slip and in all the other activities undertaken by him on behalf of the beneficial owners.

- A participant shall endeavour to resolve all the complaints against it or in respect of the activities carried out by it as quickly as possible, and not later than one month of receipt.

- A participant shall not increase charges/fees for the services rendered without proper advance notice to the beneficial owners.

- A participant shall not indulge in any unfair competition, which is likely to harm the interests of other participants or investors or is likely to place such other participants in a disadvantageous position while competing for or executing any assignment.

- A participant shall not make any exaggerated statement whether oral or written to the clients either about its qualifications or capability to render certain services or about its achievements in regard to services rendered to other clients.

- A participant shall not divulge to other clients, press or any other person any information about its clients which has come to its knowledge except with the approval/authorisation of the clients or when it is required to disclose the information under the requirements of any Act, Rules or Regulations.

- A participant shall co-operate with the Board as and when required.

- A participant shall maintain the required level of knowledge and competency and abide by the provisions of the Act, Rules, Regulations and circulars and directions issued by the Board. The participant shall also comply with the award of the Ombudsman passed under the Securities and Exchange Board of India (Ombudsman) Regulations, 2003.

- A participant shall not make any untrue statement or suppress any material fact in any documents, reports, papers or information furnished to the Board.

- A participant shall not neglect or fail or refuse to submit to the Board or other agencies with which it is registered, such books, documents, correspondence, and papers or any part thereof as may be demanded/requested from time to time.

- A participant shall ensure that the Board is promptly informed about any action, legal proceedings, etc., initiated against it in respect of material breach or noncompliance by it, of any law, Rules, regulations, directions of the Board or of any other regulatory body.

- A participant shall maintain proper inward system for all types of mail received in all forms.

- A participant shall follow the maker—Checker concept in all of its activities to ensure the accuracy of the data and as a mechanism to check unauthorised transaction.

- A participant shall take adequate and necessary steps to ensure that continuity in data and record keeping is maintained and that the data or records are not lost or destroyed. It shall also ensure that for electronic records and data, upto-date back up is always available with it.

- A participant shall provide adequate freedom and powers to its compliance officer for the effective discharge of his duties.

- A participant shall ensure that it has satisfactory internal control procedures in place as well as adequate financial and operational capabilities which can be reasonably expected to take care of any losses arising due to theft, fraud and other dishonest acts, professional misconduct or omissions.

- A participant shall be responsible for the acts or omissions of its employees and agents in respect of the conduct of its business.

- A participant shall ensure that the senior management, particularly decision makers have access to all relevant information about the business on a timely basis.

- A participant shall ensure that good corporate policies and corporate governance are in place.