The term R.E.A.C.H does not just denote pan-India expansion that Federal Bank has undertaken; each of the letter encapsulates the defining features of the Bank – that enable a deeper connection with customers and other stakeholders.

-

C

delivering exceptional value and creating a future that is inclusive and resilient.

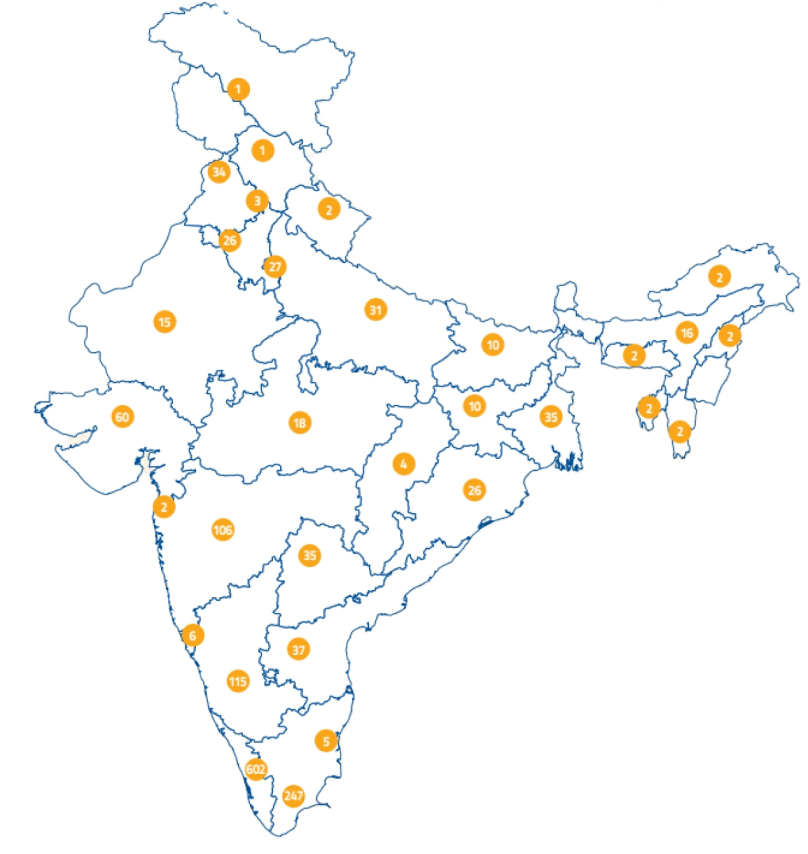

We are reaching every corner of India to meet our ever-growing number of customers through our branches and digital solutions. Our objective is to become the most admired financial institution in the nation and for all our stakeholders by offering the highest levels of service.

0 Crore+

Happy Customers

0

Banking Outlets*

* Including extension counters0

ATMs/Cash Recyclers*

* Including 2 Mobile ATMsWe have adopted a multi-pronged approach and are continually investing to increase our footprint pan-India. Along with our branch and ATM expansion and enhanced digital capabilities, we rely on alternate channels, including partnerships, to improve our customer reach.

Read More(Stake: 100%)

Federal Operations & Services Limited (FedServ) is a wholly owned subsidiary of Federal Bank that carries out operational and technology-oriented activities of our Bank.

(Associate, 26% stake)

Ageas Federal Life Insurance Company Limited (AFLIC) prominent life insurance companies. It is a joint venture between Ageas, an international insurance giant based out of Europe, and Federal Bank.

(Stake: 61.58%)

Established in 1995 and headquartered in Mumbai, Fedbank Financial Services Limited, is a publicly listed Company (NSE: FEDFINA; BSE: 544027), operating as a subsidiary of The Federal Bank Limited.

(Associate, 19.59% stake)

It provides Investment Banking, Fixed Income, Insurance Broking, Institutional Equities, Portfolio and Wealth Management Services.

0

States

0

Union Territories,

including Delhi NCT

0

Dubai & Abu Dhabi

Representative Offices

Gujarat International

Finance Tech-City (GIFT)

IFSC Banking Unit (IBU)

Customer Delight

In FY 2023-24, 94.30% of Federal Bank's transactions went digital, solidifying its leadership in banking. To sustain this momentum, we are continuously enhancing our digital prowess through AI and Machine Learning. This enables personalised customer experiences and quicker decision-making, positioning us to capitalise on new market realities.

` 0 Crore

Mobile Banking

Volume in March 2024

0

Playstore Rating

for FedMobile App

in March 2024

0%

Increase in Digital

Transactions Count

0%

Increase in Mobile

Transaction Volume for

March 2024 vs March 2023

Banking

Dear Stakeholders,

It is my privilege to present to you the Federal Bank Annual Report FY 2023-24, which marks our first integrated report.

Read Full Statement

MD & CEO

Dear Shareholders,

As I sit down to write this letter, my last one as the MD of this fantastic franchise, I am filled with both gratitude and pride. I can’t help but cast my mind back to my first letter, fourteen years ago.

Read Full Statementin Action

We aim to create long-term sustainable value for stakeholders. This was another year of customer-centric performance and consistent growth, and we are confident about maintaining this momentum through business cycles.

Delivering Value

Financial Capital

Financial Capital

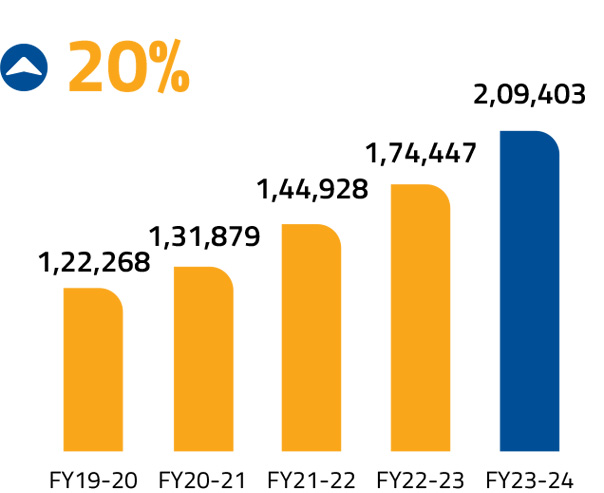

` 0,0 Crore

Total Deposits

` 0 Crore

Shareholders' Funds

` 0 Crore

Borrowings

Human Capital

Human Capital

` 2,823.09 Crore

Employee Cost

25

Number of States/UT Hired from

5.5 days

Average Training Duration per Employee

Social and Relationship Capital

Social and Relationship Capital

` 68,114.16 Crore

Total Priority Sector Lending

` 60.67 Crore#

CSR Expenditure

Intellectual Capital

Intellectual Capital

` 663.7 Crore

Spend on Technology

75 +

No. of Fintech Partnerships

Natural Capital

Natural Capital

142,626.11 GJ

Total Electricity consumption

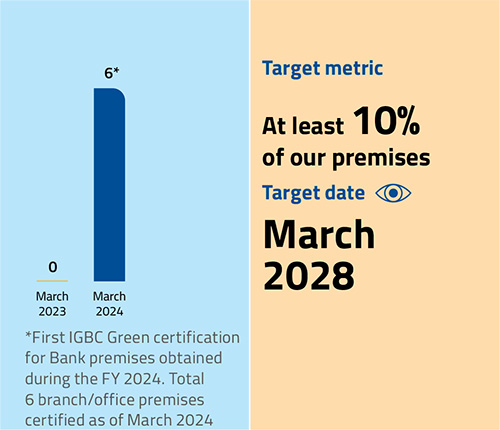

6

No. of Green Certified Premises

7.83% of CAPEX

Investment in Energy & Water Conservation Projects

Manufactured Capital

Manufactured Capital

1,504

Total number Banking outlets

2,015

Total no. of ATMs/CDMs

Financial Capital

Financial Capital

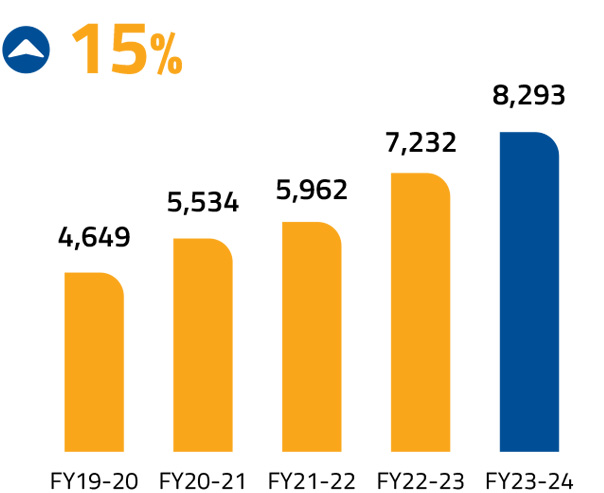

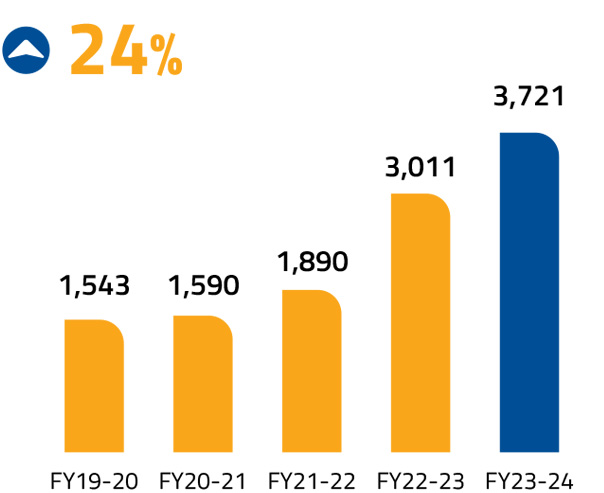

` 3,721 Crore

PAT

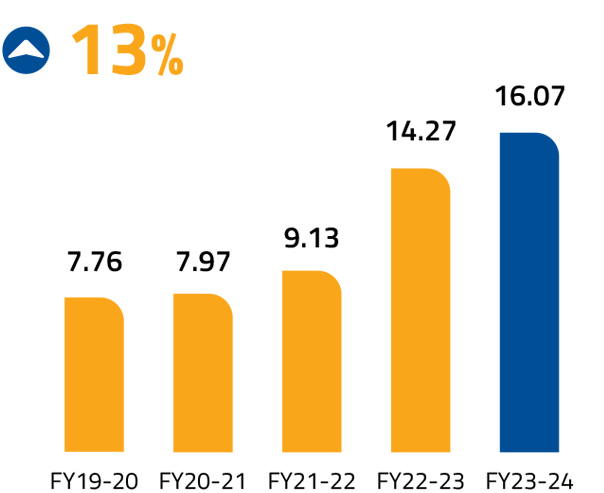

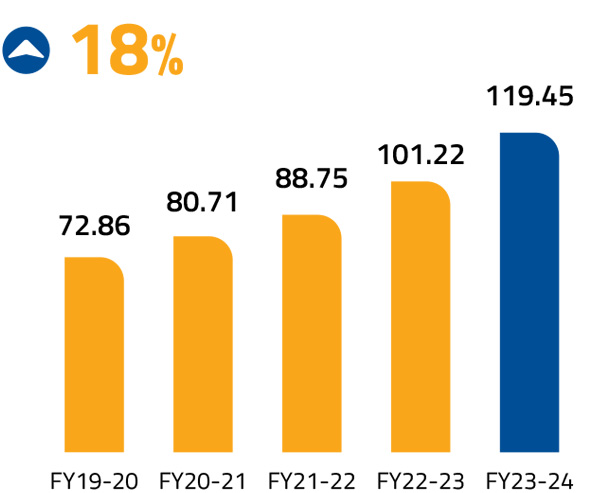

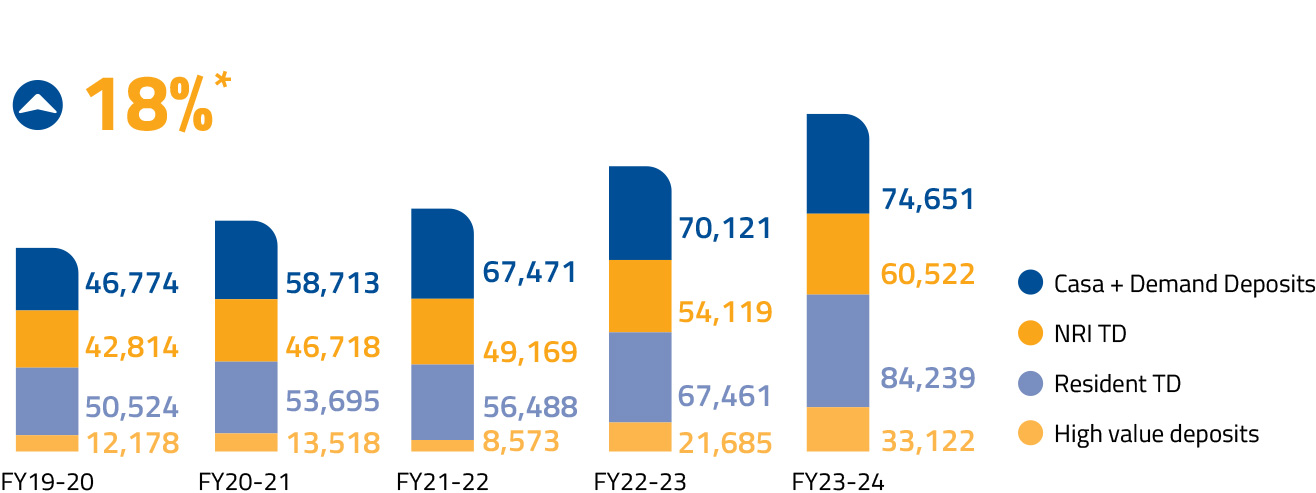

18%

Increase in total deposits

14.73%

Return of Equity (RoE)

Human Capital

Human Capital

` 31.92 Crore

Business Per Employee

3.19%

Voluntary attrition rate (Less by 15% compared to y.o.y)

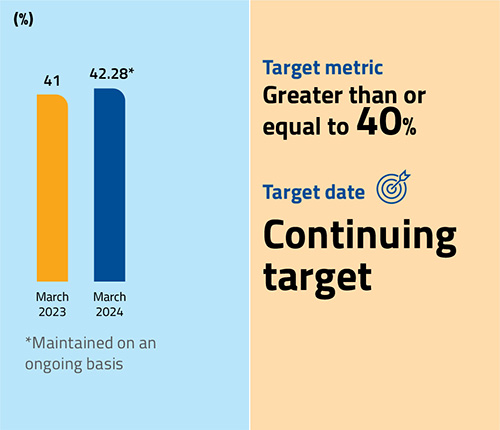

47.83%

New Women Hires

Social and Relationship Capital

Social and Relationship Capital

4,61,271 Individuals

Total Enrolment to Social Security Schemes

40,95,790 Individuals

Total CSR Beneficiaries

Intellectual Capital

Intellectual Capital

94.30%

Share of Digital Transactions

4.6

Android App Rating

Natural Capital

Natural Capital

90901 kWh

Electricity Saved

2.81 million metric tonnes

Avoided Emissions through Green Lending (CO2e per annum)

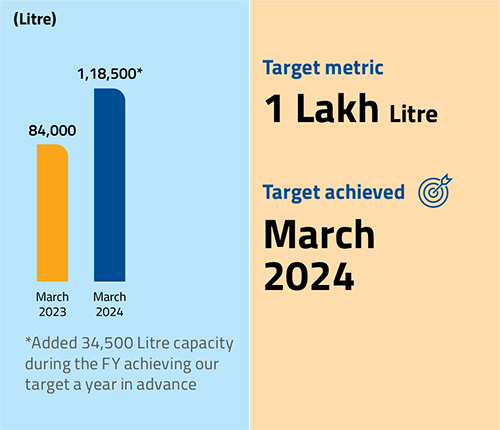

~2.5 Lakh litres

Water Saved

Manufactured Capital

Manufactured Capital

64%

Semi urban and rural branches

1.82 Crore

Total customers served

Collaboration

Our stakeholders are those who are most impacted by our business activities. We proactively engage with them through a variety of channels to understand their concerns and interests to provide the most beneficial responses.

Read More

Assessment

At Federal Bank, materiality assessment is a cornerstone of our commitment to integrating sustainability into our business strategy. We conducted our materiality assessment in FY 2022-23, aligning with the Global Reporting Initiative (GRI) standards.

Read More

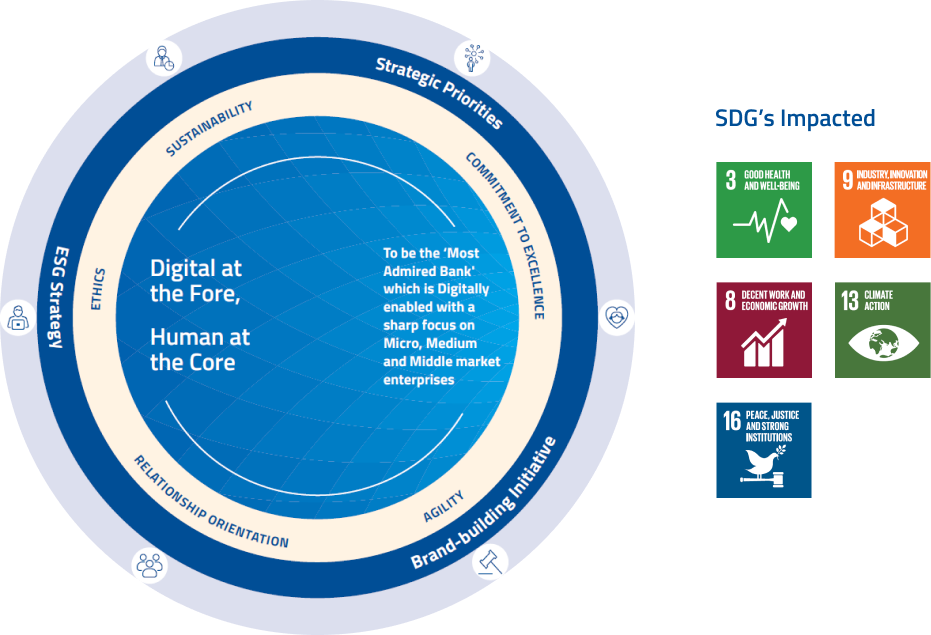

Course to

Become the Most Admired Bank

To emerge as the Most Admired Bank in India, we have aligned our activities with this vision, striving for higher, sustainable, and more inclusive growth.

Read More

In today’s ever-evolving financial landscape, effective risk management is fundamental to safeguarding our Bank’s stability and achieving long-term success.

Read More

Federal Bank’s robust ESG strategies, set by the Board, are closely aligned with our Bank’s risk appetite and ESG roadmap. We have committed to several ESG targets in the medium and long term, and our progress is closely monitored by the Board and transparently conveyed to external stakeholders. The core values framework encompasses all three pillars of ESG

Greener Tomorrow

We have just one planet, and its well-being is closely linked to our own. Our efforts to reduce GHG emissions, decrease energy consumption, minimise the use of plastic, encourage digital applications, and promote environmentally responsible investments are spurred by this fundamental realisation.

Foundation

We are committed to empowering our investors to actively participate in our governance, share our sustainable profits, and gain a comprehensive understanding of our financial health through a culture of transparent and proactive engagement. We strive to build strong shareholder connections and create a long-term, sustainable business model that you will be proud of.

of Integrity

Federal Bank is strongly dedicated to maintaining the highest standards of governance, ethics, and integrity. To safeguard the security and stability of our banking services, we adopt best-in-class banking practices and maintain strong institutional governance and risk frameworks. These frameworks and practices undergo periodic review to adapt to the evolving operating environment.

Recognised as the ‘Bank of the Year 2023’ in India instituted by The Banker, a well-known publication under the Financial Times umbrella

Won the ‘Future Ready Organisations Award 2023-24’ – Economic Times

Honoured with ‘Amity Banking Excellence for Sustainable Banking’

Recognised as the ‘Best AI & ML Bank’, Runner-up in ‘Digital Engagement’ and received a special mention for driving Financial Inclusion by the Indian Banks Association

Recognised as the ‘Best Bank in Fintech’ initiative - Business Today

Won 5 Awards in different categories at the Indian Chamber of Commerce Emerging Asia Banking Awards

Ranked the 1st Runner-Up in the ‘Diversity & Inclusion Excellence Award’ in the category of ‘Best Employer for Women’ (In Large Category) from The Associated Chambers Of Commerce And Industry Of India (ASSOCHAM)

Recognised as ‘ESG Champions of India 2024’ in the Commercial Banks sector at the Dun & Bradstreet ESG Leadership Summit 2024