Foundation

We are committed to empowering our investors to actively participate in our governance, share our sustainable profits, and gain a comprehensive understanding of our financial health through a culture of transparent and proactive engagement. We strive to build strong shareholder connections and create a long-term, sustainable business model that you will be proud of.

The Board oversees the actions and results of the management to ensure that the medium and long-term objectives of enhancing shareholder value are met. The Board also has the discretion to engage the services of external experts/advisors, as deemed appropriate.

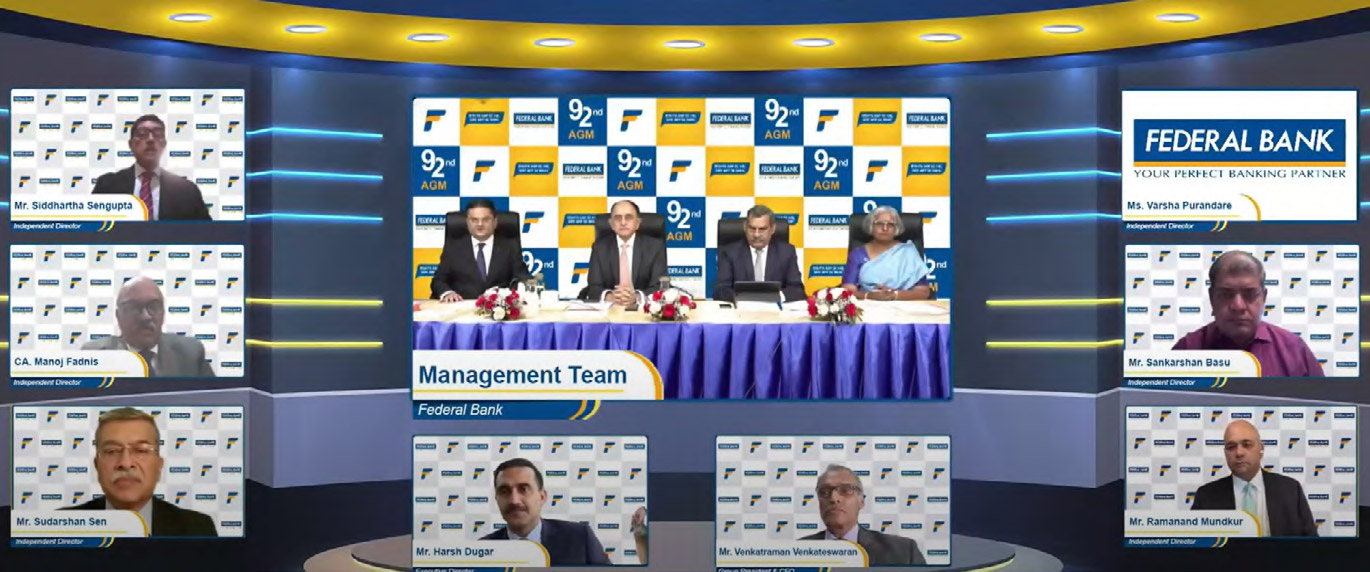

ANNUAL GENERAL MEETING

Our AGM brings together Bank’s management, Board and shareholders for a collective dialogue. The formal online meeting was held last year and the Management of the Bank, including the Board members discussed the performance, strategy, and governance of our Bank at length with all the shareholders. Shareholders voted on certain resolutions like capital requirements, approving financial statements, declaring dividends, etc.

0+

Attendees for Investor Meetings

ANALYST MEETS AND INVESTOR CONFERENCES

As part of our outreach programme, we actively engage and remain connected with the entire analyst community. We consider the analyst community as our bridge to the investor community. Around 30 analysts, including those from renowned research houses cover our stock. We are happy to be one of the most favoured stocks in terms of analyst coverage.

In terms of Investor Conferences, we have participated in almost all the conferences held in India as it helps open communication with investors. We showcase our performance, financial numbers, strategies and the way forward plans to our investors.

CAPITAL RAISE

We also successfully raised capital to the tune of ~` 4,000 Crore with a mix of QIP and Preferential allotment. We believe that this is a result of the consistent and continuous engagement the management had with our stakeholders.

Shareholder Returns

DIVIDEND

Protecting shareholder value is the guiding principle of our Bank. Federal Bank believes in striking a fine balance between retained earnings and dividend distribution. The Board of Directors have recommended a dividend of 60% i.e. ` 1.20 per Equity Share on face value of ` 2 each for FY 2023-24 subject to the approval of the Members in the ensuing Annual General Meeting.

FINANCIAL PERFORMANCE

We experienced a year of superior financial performance, with the highest-ever profit earned for a financial year while maintaining the best asset quality. To know more about our financial performance read page 46.