People Focused.

As a strong, relationship-led organisation, we specialise in offering tailored solutions to corporates, MSMEs, and capital market clients across the value chain. We aspire to be a banker first before being a lender.

Performance Highlights

0 Million

Current/Savings Accounts Opened

` 0 Crore

CV/CE Advances

` 0 Crore

Business Banking Advances

` 0 Crore

Retail Advances

` 0 Crore

Gold Loans

` ,0 Crore

Deposits

` Crore

Agri Advances

` Crore

MFI

` , Crore

Retail Credit Book

PERFORMANCE REVIEW

As we expanded our presence across the country, we reached more number of people and achieved progress in customer acquisitions and growth in the retail business.

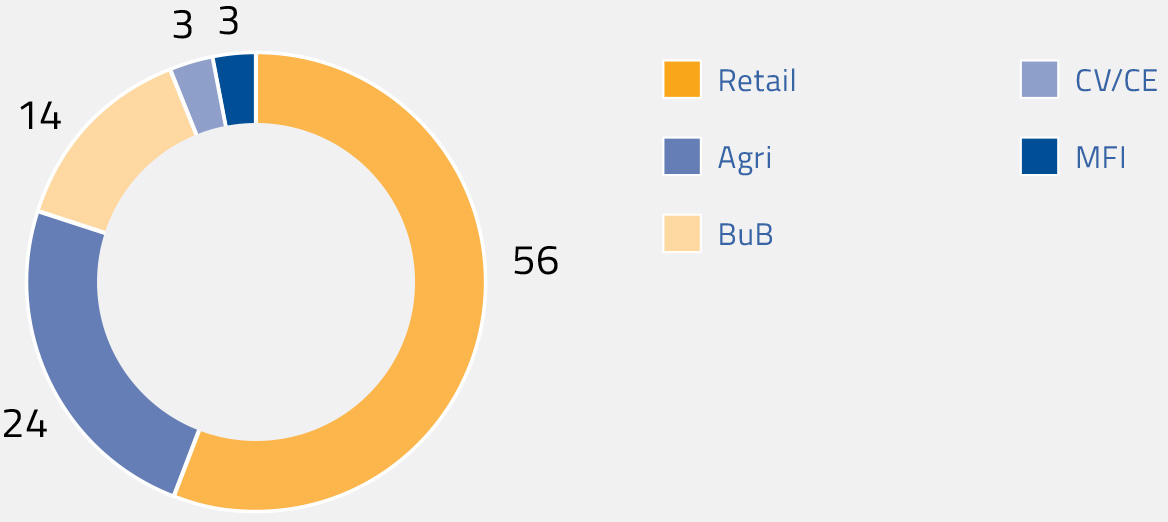

Retail Credit Book Mix

(%)

Credit segments are realigned at the beginning of every FY.

Deposit Mobilisation and CASA

Despite fierce competition, our Bank’s deposits grew by 18.35%, surpassing the industry’s growth rate of 13.47%*. Our market share in deposits grew 5 bps Y-o-Y. Although CASA deposits showed a growth of 6.4% Y-o-Y overall CASA ratio decreased 330 bps to 29.38%

*Industry position as on March 22, 2024

NRI Business

Despite changes in migration and settlement patterns impacting the industry, we maintained our significant presence in the Non-Resident (NR) business, achieving an 8.16% growth in FY 2023-24.

Assets under Management and Insurance Business

The Assets Under Management (AUM) in our Wealth Management Services (WMS) partnership have surpassed C 5,000 Crore as of March 31, 2024, up from The bank has achieved a fee income of C 180.69 Crore through the distribution of insurance and para-banking products. The Bank partnered with Cholamandalam MS General Insurance Co Ltd under Bancassurance arrangement for providing insurance exclusively for CV/CE Business

ACHIEVEMENTS

- ` 2.5 Lakh credit card in force achieved in March 2024, with spending on credit cards doubling to ` 360 Crore at the same time.

- The Housing Loan portfolio crossed ` 28,000 Crore, registering a growth of 12%, the Retail LAP portfolio crossed ` 11,700 Crore, registering a growth of 18%, and the Auto Loan portfolio grew by 34%, crossing ` 7,300 Crore in book size.

Stellar

The Bank launched the STELLAR savings account, targeting resident individuals. This account includes a one-year wellness pack and complimentary insurance. Within two months of its February launch, 17,000 new customers opened STELLAR accounts.

NRE Eve+

On 20th July 2023, the Bank introduced NRE Eve+, an exclusive savings account for NRI women. Benefits include complimentary airport lounge access, exclusive deals, and zero balance accounts for two children. By 31st March 2024, NRE Eve+ had 11,000 accounts, attracting over 4,200 new customers.

Shreni - Institutional Savings & Current Accounts

In March 2024, the Bank launched Shreni Accounts for institutional clients, including Current Account, Premium Savings, and Premium Current variants for Trusts, Associations, Societies, and Clubs.

Inward Remittance

In FY 2023-24, the Bank facilitated over C1,80,000 Crore in inward remittance through Rupee Drawing Arrangement and partnered with five new remittance companies, including a major bank in Oman.

Empowering the Fishermen of Nagercoil

Nagercoil, a small village in the Kanyakumari district, relies on fishing as its primary occupation. Fishermen there face significant challenges. Federal Bank, in collaboration with Coastal Development Group, aimed to support this unorganised sector by offering credit to fishermen and related businesses. Within six months, loans were provided to 700 group members, each receiving ` 6 Lakh per Self Help Group. These loans addressed various needs, including repaying high-interest loans, marriage expenses, and children's education. The fishermen's excellent repayment record highlights their financial responsibility. This initiative empowered individuals, strengthened the local economy, and transformed Nagercoil's financial and social landscape.

0

Beneficiaries

` 0 Crore+

Total Funding Disbursed

0

Self Help Groups