to Excellence

As a strong, relationship-led organisation, we specialise in offering tailored solutions to corporates, MSMEs, and capital market clients across the value chain.

Performance Highlights

0

New Clients Added to CIB

0

New Clients Added to COB

0

New Clients Onboarded over the Last Three Financial Years

` 0 Crore

Wholesale Credit Book

` 0 Crore

Corporate Banking Advances

` 0 Crore

Commercial Banking Advances

` Crore

SCF Business

` Crore

Fee Income

` Crore

GIB Business

Credit segments are realigned at the beginning of every FY. Vertical-wise advance figures do not account for sale via IBPC

PERFORMANCE REVIEW

Our strategic focus has been to achieve better coverage and become the preferred financial partner to corporates across India.

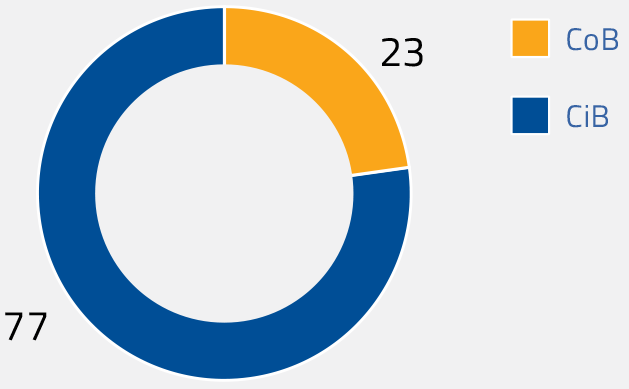

Wholesale Credit Book Mix

(%)

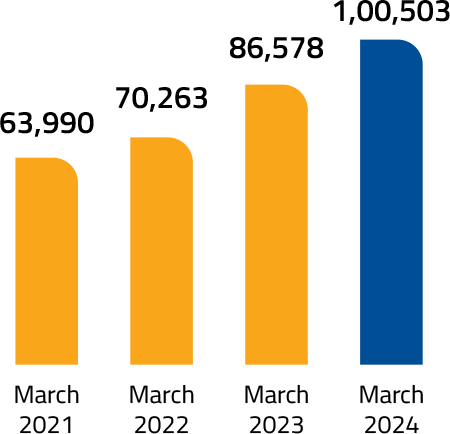

Our Bank’s approach has been to strengthen our presence through the entire lifecycle of clients. The Wholesale Banking vertical also offers products in trade, treasury, transaction banking and supply chain finance. Three-year CAGR of wholesale banking total assets have been 16%.

Wholesale Banking Total Assets

(` in Crore)

~ ` 0 Crore

Average Ticket Size of Wholesale Banking

Supply Chain Finance (SCF)

SCF is a key growth driver of the Wholesale Banking division. Our robust supply chain platform provides end to end digital solution for corporate ecosystem and thus eliminates need for paper-based processes. In the last three years, the SCF book has grown from ` 1,420 Crore to ` 7,134 Crore in FY 2023-24 at a CAGR of 71.3%. This vertical also started facilitating structured long-term factoring programmes and more than 43% of the book (excluding factoring) qualifies for PSL (Priority Sector Lending) benefit.

Capital Market

The capital markets segment offers facilities for debt and equity market clients. It offers bespoke solutions and advisory services to its clients, especially in the debt market.

ACHIEVEMENTS

- Wholesale Banking has achieved a significant milestone of ` 1 Trillion asset book.

- The self-funding ratio improved by 3% during the year to 32%.

- Fee-to-average assets ratio stood at 57 bps versus 54 bps in the previous year.

- Being at the forefront of providing innovative solutions to the client’s requirements, we have started offering digital cross-border trade transactions through blockchain, thereby reducing the working capital cycle and cost significantly for our clients dealing in exports/imports.

- We were amongst the Banks to participate in the first-ever large value syndicated factoring programme ever done in India.

- We have inked an MOU with 3 large OEMs across various sectors (Auto, Metal and Construction) for Channel Finance arrangement as one of their preferred financiers. This will help us work in developing a granular book with a higher yield.

Wholesale Banking: Helping Auto Ancillary Company Grow

About seven years back, we got in touch with an auto ancillary Company. It had small scale of operations with ~J180 Crore topline and 7% EBITDA margins and BBBcredit rating. Our analysis depicted that Company had robust financial foundation and promising business prospects. Based on a thorough appraisal, we finally onboarded them in 2019, with a structured product for their newly added export client. Currently, the Company holds an A credit rating, a massive 4 rating upgrade in 5 years. It has grown its topline 4x with 2.5x expansion in EBITDA margins from our entry point. We are proud to say that we are the primary Banker to the Company with the majority of exports routed through us.

0

Rating Upgrade in 5 years

0 X

Topline Growth