Assessment

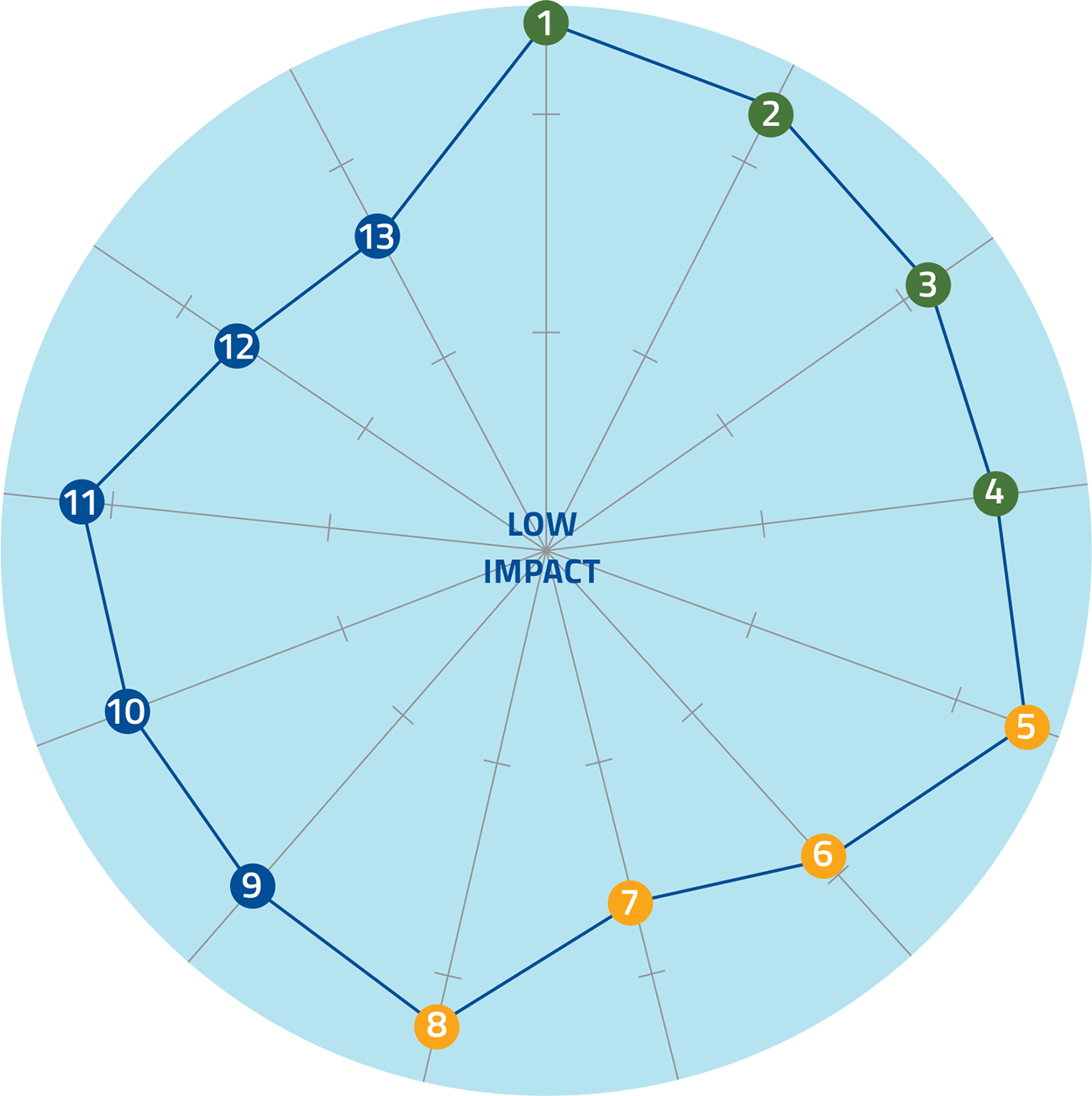

At Federal Bank, materiality assessment is a cornerstone of our commitment to integrating sustainability into our business strategy. We conducted our materiality assessment in FY 2022-23, aligning with the Global Reporting Initiative (GRI) standards. This ensured we captured the most significant topics influencing our operations and stakeholder relationships, recognising the critical importance of identifying and addressing the issues that matter most to our stakeholders and the long-term success of our Bank.

Materiality is a vital concept for Federal Bank as it helps us focus on the areas that can have the most substantial impact on our business and stakeholders. By identifying material topics, we can strategically address economic performance, environmental stewardship, social responsibility, and governance issues. These topics guide our sustainability initiatives, enabling us to proactively manage risks, seize opportunities, and enhance our resilience in an ever-evolving financial landscape. Through this process, we aim to create long-term value for our stakeholders while contributing to sustainable development.

PHASE 1

Identification of Sustainability Topics

We comprehensively analysed Federal Bank's organisational context in the first phase. This included examining our activities, business relationships, sustainability context, and stakeholder perspectives. We assessed the potential impacts of our operations on various sustainability dimensions. Stakeholder and expert input was actively sought, providing valuable insights. This phase resulted in a detailed understanding of significant sustainability impacts relevant to our Bank.

PHASE 2

Shortlisting of Material Topics

Following identification, we shortlisted 40 topics as potentially material. This process considered the financial sector's characteristics and the broader business environment. We benchmarked against peer findings and incorporated stakeholder interests and concerns, ensuring the shortlisted topics were highly relevant to the Federal Bank's operations.

PHASE 3

Prioritisation of Material Topics

In the final phase, we prioritised the material topics based on their impact on the economy, environment, and people, including human rights. We disseminated surveys to gather comprehensive stakeholder inputs. Analysing this data resulted in a prioritised list of 13 significant material topics. This list now guides our sustainability initiatives, focusing on areas that drive the most value and impact.

HIGH IMPACT

ENVIRONMENT

- Sustainable Finance

- Climate Change Risk and Impact

- Product Innovation

- GHG Emission Management

SOCIAL

- Employee Well-being and Development

- Customer Privacy and Data Security

- Customer Satisfaction

- Digital Leadership

GOVERNANCE

- Corporate Governance and Ethics

- Economic Performance

- Regulatory Compliance

- Fraud Risk Management

- Transparency and Fair Disclosure

Material Topic

Management Approach

Potential/Actual Impact

Material Topic

Corporate Governance and Ethics

Management Approach

We uphold strong corporate governance and ethical practices through our policy on anti-bribery and anti-corruption. The policy and procedures ensure transparency, accountability, and trustworthiness, leading to long-term sustainability and stakeholder confidence.

Potential/Actual Impact

Negative

- Impacts brand value and reputation

- Affects transparency on compliance-related matters

- Affects the confidence of various stakeholders

GRI 2: General Disclosures, GRI 205: Anti-Corruption

Material Topic

Economic Performance

Management Approach

Sound financial performance and stability are necessary to ensure our business continuity, investment, and economic growth, leading to sustainable development.

The following policies have been adopted in this regard: lending policies, investment policies and deposit policies.

Potential/Actual Impact

Positive

- Impacts the share price

- Impacts the relationship with stakeholders

GRI 201: Economic Performance

Material Topic

Regulatory Compliance

Management Approach

Our Bank ensures compliance with laws, regulations, and standards to ensure reduced legal risks, foster trust, and avoid penalties. This also ensures continuous support for sustainable business operations.

Potential/Actual Impact

Negative

- Affects compliances with current and emerging regulations

GRI 205: Anticorruption, GRI 201: Economic Performance

Material Topic

Digital Leadership

Management Approach

The Bank’s digital leadership enables it to adapt to technological advancements, drive innovation, and create competitive advantages.

Potential/Actual Impact

Positive

- Delivering fast and convenient services round the clock 24/7 for customers

- Operational efficiencies

- 84.15 tonnes of paper saved during the year

- 3.73 Lakh litres of fuel saved due to transformation to digital journey by our customers

Material Topic

Employee Well-being and Development

Management Approach

Promoting employee well-being and providing growth opportunities enhances productivity and job satisfaction among the staff and leads to talent retention. The Bank’s commitment to its employees is reflected via the Diversity, Equity, and Inclusion Policy and ESG Policy.

Potential/Actual Impact

Positive

- Job satisfaction of employees and talent retention

- Increases the productivity of employees

- Lowered voluntary attrition rate to 3.19%

GRI 401: Employment, GRI 404: Training and Education

Material Topic

Customer Privacy and Data Security

Management Approach

Protecting customer privacy and ensuring data security is a top priority for the Bank and enables it to build trust, safeguard personal information, and maintain brand reputation.

Potential/Actual Impact

Negative

- Impacts business, customer satisfaction and brand value

GRI 418: Customer Privacy

Material Topic

Sustainable Finance

Management Approach

The Bank is committed to integrating Environmental, Social, and Governance (ESG) factors into its financial decisions to mobilise investments for sustainable development.

Potential/Actual Impact

Positive

- Impacts the economy and risk mitigation

- Enhances brand reputation and trust

- ` 6,962 Crore green finance portfolio

GRI 201: Economic Performance

Material Topic

Fraud Risk Management

Management Approach

Our robust fraud risk management systems and its policy on Combating Financial Crimes, safeguard resources, prevent financial losses, and help uphold ethical business practices.

Potential/Actual Impact

Negative

- Affects business’s performance and continuity

- Impacts the Bank’s reputation

GRI 205: Anticorruption

Material Topic

Climate Change Risk and Impact

Management Approach

Assessing and mitigating climate change risks, including Greenhouse Gas (GHG) Emissions, helps the Bank combat global warming and its adverse effects. The Bank’s commitment is reflected in its ESG Policy.

Potential/Actual Impact

Negative

Physical and transition risks.

The following steps have been taken to adapt and mitigate the risks:

- Green loans

- Exclusion list

- Phased reduction of coal-related exposure

- Generation of renewable energy

- LEDfication

- Using star-rated air conditioners which reduce power consumption

- Capturing Scope 1, 2 and 3 Emissions

- Disaster recovery mechanism

GRI 305: Emissions, GRI 307: Environmental Compliance

Material Topic

Product Innovation

Management Approach

The Bank continuously strives to drive product innovation. This, in turn, drives competitiveness, addresses market needs, and enables sustainable consumption and production.

Potential/Actual Impact

Positive

- Impacts business, customer satisfaction, acquisition

Material Topic

Transparency and Fair Disclosure

Management Approach

The Bank’s transparent and fair disclosure practices help promote accountability, stakeholder engagement, and informed decision-making.

Potential/Actual Impact

Positive

- Impacts stakeholder relationships

GRI 2: General Disclosure

Material Topic

Customer Satisfaction

Management Approach

We prioritise customer satisfaction and experience. This helps improve customer loyalty, and brand reputation and foster positive relationships with our customers.

Potential/Actual Impact

Positive

- Impacts business and profits

- Impacts brand reputation

GRI 416: Customer Health & Safety

Material Topic

GHG Emission Management

Management Approach

Managing and reducing Greenhouse Gas (GHG) Emissions to mitigate climate change impacts and support a lowcarbon economy. In this regard, the Bank has taken various initiatives to reduce its energy consumption pan-India.

Potential/Actual Impact

Negative

- Impacts the Bank's energy management

- Impacts brand value

The following steps were taken towards efficient energy management:

- Generation of renewable energy

- LEDfication

- Using star-rated air conditioners which reduce power consumption

- Emissions measurement and monitoring

GRI 305: Emissions, GRI 307: Environmental Compliance