We aim to create long-term sustainable value for stakeholders. This was another year of customer-centric performance and consistent growth, and we are confident about maintaining this momentum through business cycles.

Key Parameters

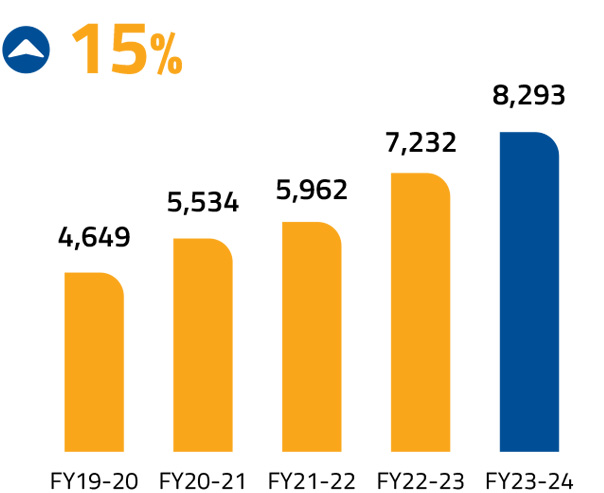

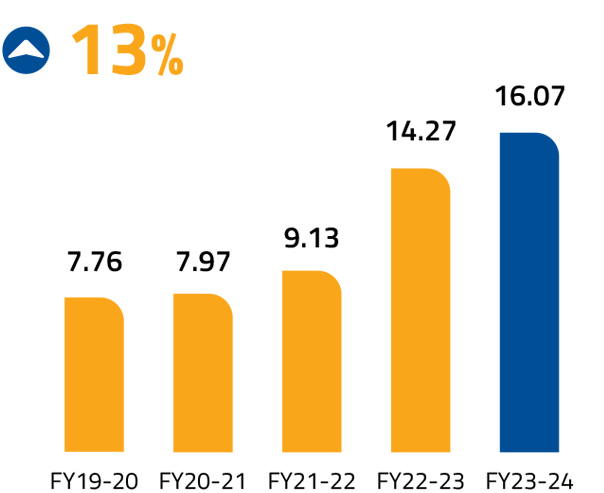

Net Interest Income (` in Crore)

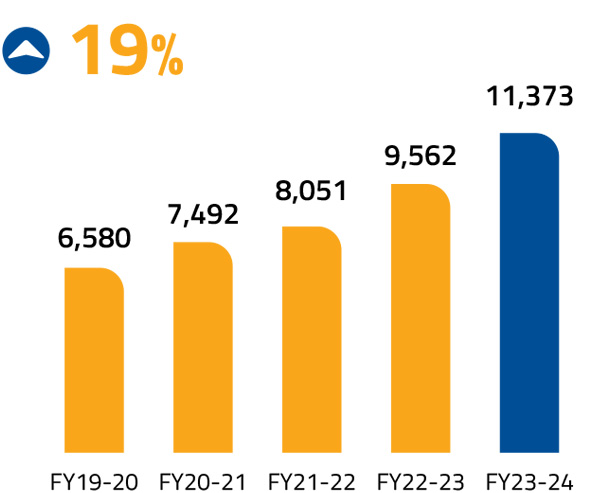

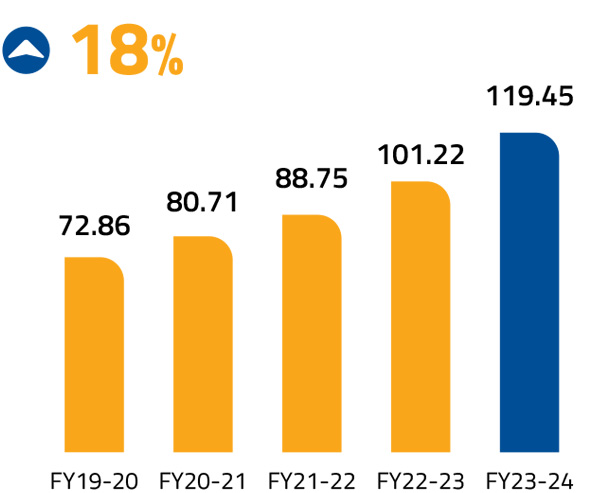

Net Total Income (` in Crore)

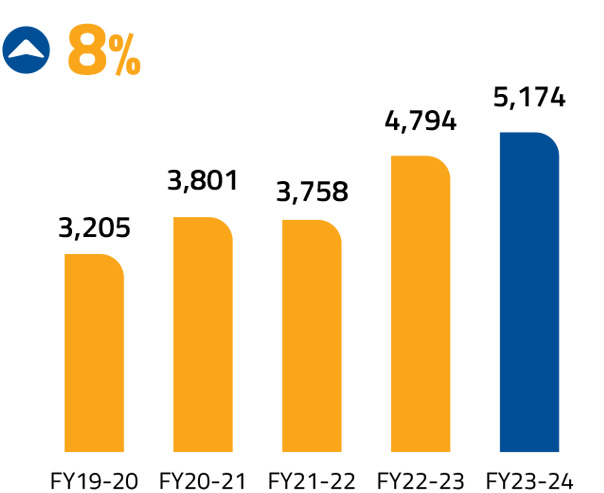

Operating Profit (` in Crore)

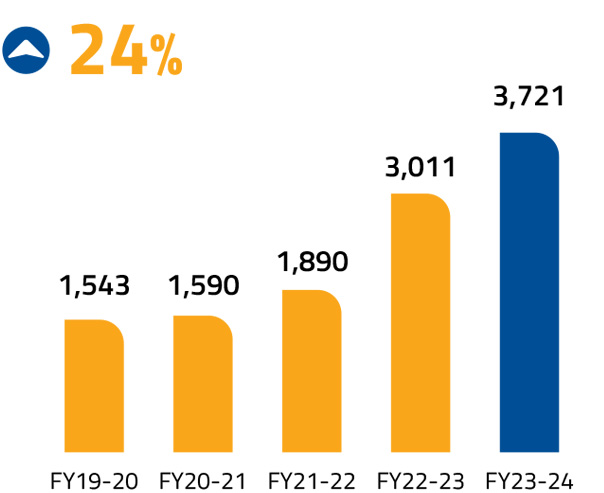

Net Profit (` in Crore)

Earnings Per Share (Basic) (`)

Book Value Per Share (`)

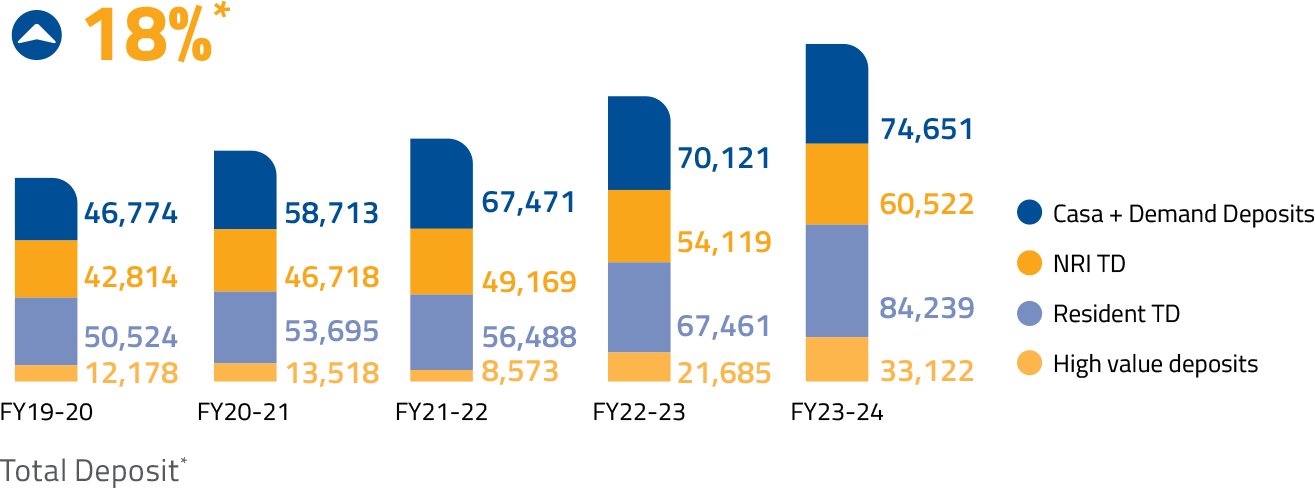

Deposits (` in Crore)

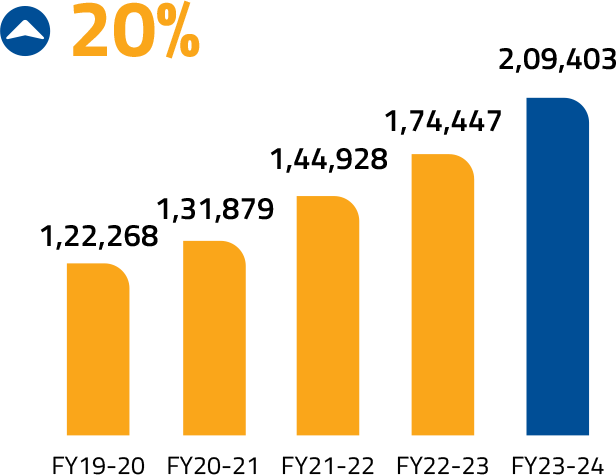

Net Advances (` in Crore)

Key Ratios

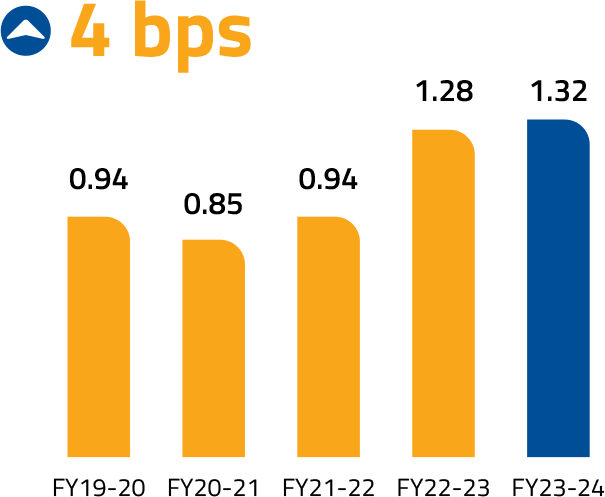

RoA (%)

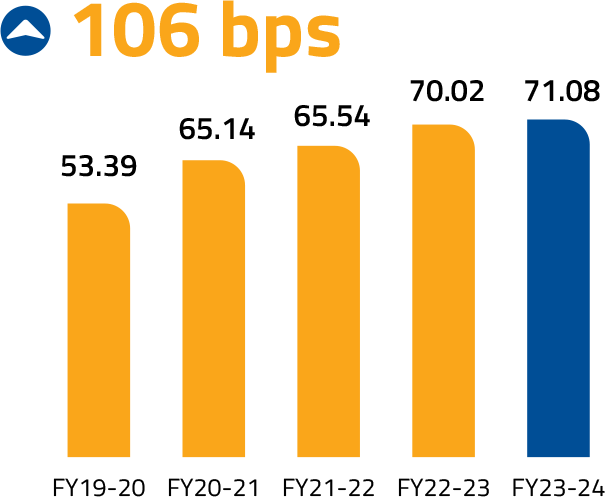

Provision Coverage Ratio* (%)

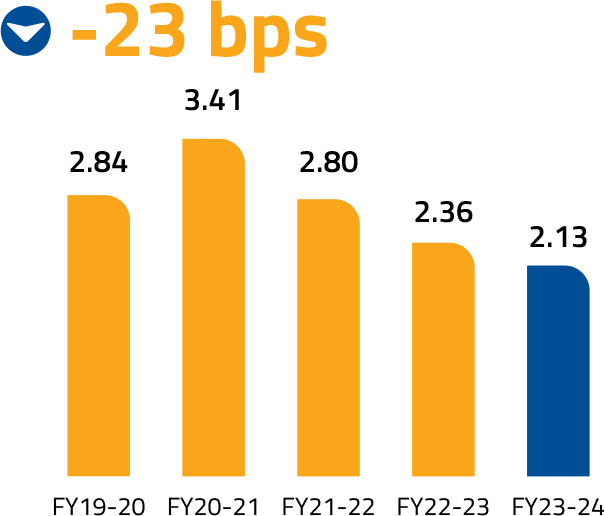

Gross NPA (%)

Gross NPA (%)

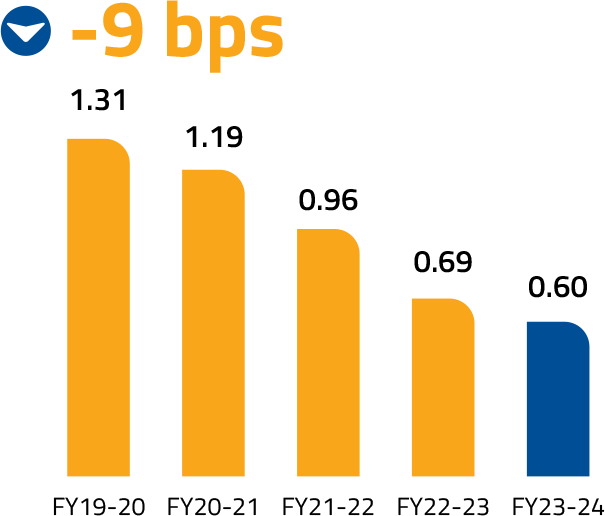

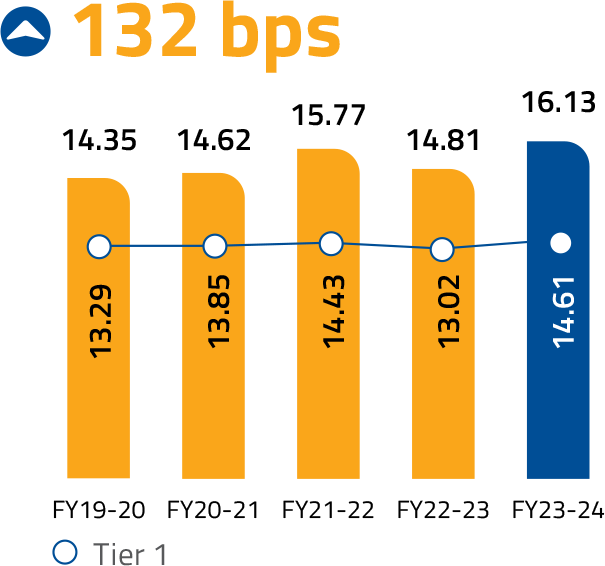

Capital Adequacy Ratio and Tier 1 Capital (%)

FATF Recognition: Collaborating for a Safer Financial System

The Financial Action Task Force (FATF) leads global action to tackle money laundering, terrorist and proliferation financing. The FATF promotes global standards to mitigate the risks, and assesses whether countries are taking effective action. A meeting was convened by the Assessment Team of FATF at Mumbai in November 2023. The FATF delegation to India was led by Central Bank of Brazil and other member countries viz. South Africa, the UK, the US and Japan. This is a once-ina-decade evaluation where select banks are chosen by the Ministry of Finance (Dept of Revenue) and RBI to interact with the Assessors based on its effectiveness in demonstrating capabilities, structuring the framework and operational measures after several rounds of filtering. We are proud that our Bank was chosen along with four other Banks to represent the country.

This shows that our strategic priorities and sustainable business practices lead to the creation of value for all our stakeholders, including investors, customers, employees, partners, communities and government and regulatory authorities.