Stability

In today’s ever-evolving financial landscape, effective risk management is fundamental to safeguarding our Bank’s stability and achieving long-term success. At Federal Bank, we are committed to a proactive and comprehensive risk management framework that identifies, assesses, mitigates, and monitors potential risks across all our operations.

Economic Risk

Key Risks

Economic risks encompass global as well as domestic factors like economic downturns, inflation, rising interest rates, and currency fluctuations that can negatively impact a Company's financial performance

Response

Federal Bank continuously monitors domestic as well as global developments and responds appropriately

Credit Risk

Key Risks

Increasing interest rates and volatile market conditions can make it difficult for borrowers to meet their repayment obligations

Response

Credit-risk architecture, policies, processes, and systems for managing credit risk through a centralised credit risk management division enable the Bank to effectively respond

Market and Liquidity Risk

Key Risks

Challenges posed mainly in the bank’s reserve management by tightening monetary policy and equity and forex market movements

Response

The Bank has set risk appetite and VaR limits. It uses various tools for stress testing and monitoring and containing market risk

Operational Risk Management

Key Risks

Potential for losses arising from internal flaws or external events that disrupt everyday business operations, including human error, inadequate processes or even natural disasters

Response

The Bank uses Risk and Control Self Assessments (RCSA) and monitors Key Risk Indicators (KRI). There is a fraud prevention framework in place

SHARPENING OUR SWORDS: STRENGTHENING AML DEFENCES

Financial crime is becoming increasingly common and Federal Bank is committed to nip it in the bud. To strengthen defence against such crime, the Anti Money Laundering Department of Federal Bank arranged for a training in association with Fintelekt, a financial crime compliance specialist. Fintelekt Advisory Services is a specialist in research, training and advisory services in Anti-Money Laundering and countering Terrorist Financing.

A half-day training programme for 42 newly-inducted interns under Federal Integrated Programme in AML was conducted offline and 10 sessions for the entire AML team through online mode. FCCS is a work-and-study programme designed by Manipal Global Education Services that provides 24 months of hybrid learning model comprising of classroom, virtual sessions and on the job training. The sessions focussed on comprehensive exploration of AML through case studies with intricate details of CFT and KYC.

Business Continuity Risk

Key Risks

Potential financial losses stemming from disruptions that prevent critical operations from functioning. These disruptions can be internal, like IT failures, or external, like cyberattacks or natural disasters

Response

Bank-wide BCM (Business continuity management) plan is in place. A Central Crisis Management Team (CCMT) exists to take responsibility and act swiftly in case of emergency

Information Security and Cyber Security Risk

Key Risks

Such risks for a Bank involve the potential for financial losses, reputational damage, and regulatory penalties. These risks stem from unauthorised access, use, disclosure, disruption, modification, or destruction of sensitive customer and Bank information. Cyberattacks, malware, system vulnerabilities, and human error can all contribute to these risks

Response

The Bank safeguards information through a robust framework, a dedicated CISO team, and 24/7 security monitoring by a SOC. They prioritise user awareness through regular training programmes

Compliance Risk

Key Risks

Compliance risk for a Bank refers to the potential for financial penalties, legal repercussions, or reputational damage resulting from failing to comply with relevant laws, regulations, and industry standards

Response

The Bank has policies and controls to ensure compliance with laws and regulations. Continuous evaluation and policy updation to remain relevant and adoption of best practices are part of ongoing efforts

Climate Risk

Key Risks

Climate change can impact various areas of Banks operations, including credit risk, market risk, reputation risk among others

Response

Bank has set a risk appetite for climate risk and takes actions to increase sustainable lending

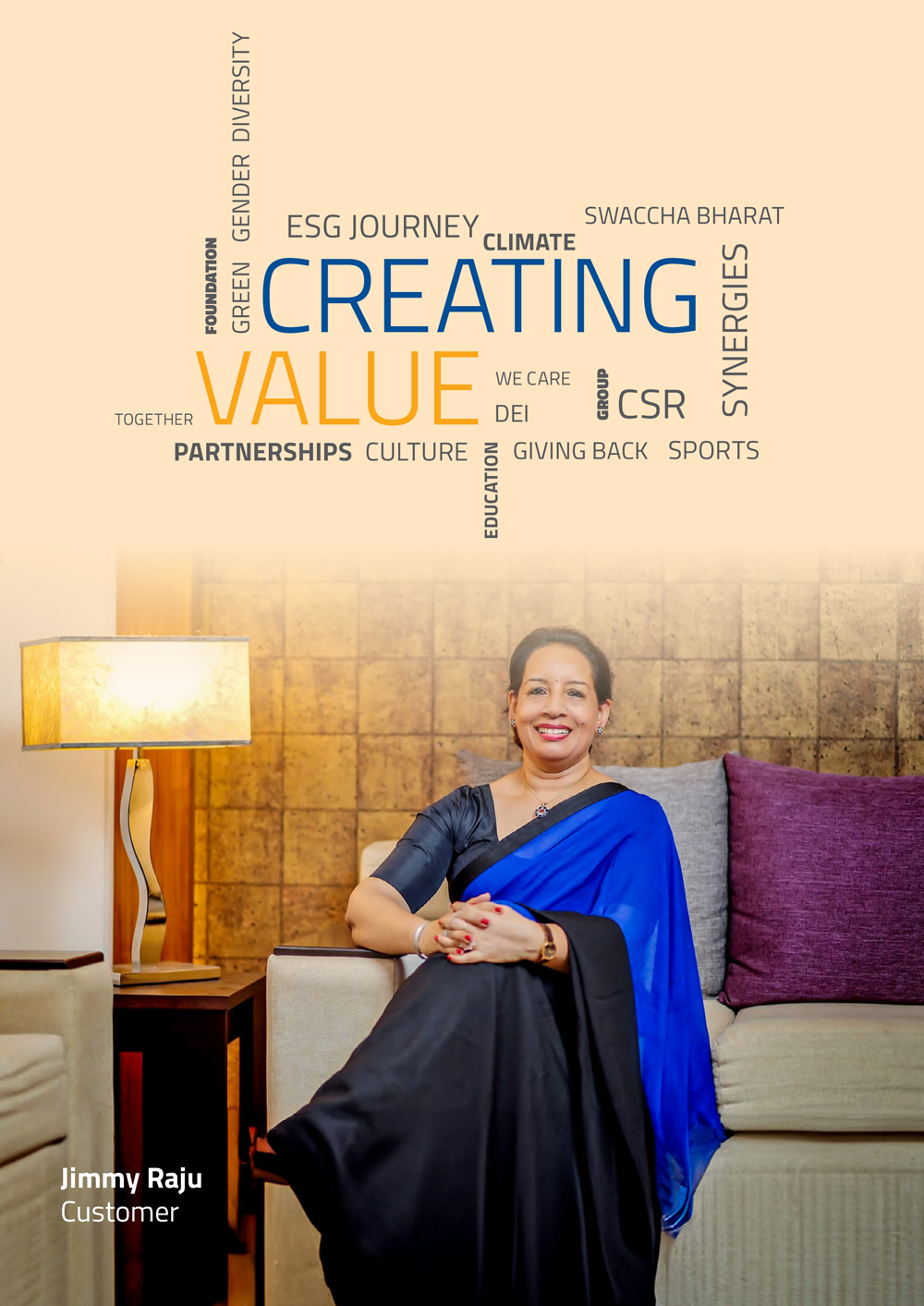

A Recipe for Success

In 1994, Jimmy Raju founded Grandma's pickles in Marady, Kerala, with the goal of creating a highquality pickle brand. Despite early success, Jimmy faced challenges in securing funding due to limited collateral and hesitant traditional lenders. With initial financial support from her husband, she built a solid business strategy and earned the trust of lenders. A loan from Federal Bank enabled her to expand Grandma's beyond regional markets and start exporting to Europe. “This support has been a morale booster in my journey as an entrepreneur,” says Jimmy.

Today, Grandma's employs over 200 people, becoming a critical source of livelihood for many.