Offering a Holistic Range of Banking Solutions

As a Bank, we are dedicated to providing a universal banking platform that meets the needs of both our retail and wholesale customers. We leverage our customer insight to create personalised and integrated products and services that cater to their unique financial requirements. This enables us to deliver a diverse value proposition basket that is built upon the foundation of trust that we have earned from our customers across the sectors. Our ultimate goal is to craft exceptional customer experiences by nurturing long-lasting relationships, and delivering comprehensive banking solutions.

Our retail banking segment is dedicated to serving the diverse needs of individual clients and businesses. We offer a comprehensive range of products and services tailormade to meet their specific requirements. Our offerings include CV/CE financing, agri, business, and retail banking. Within the retail banking segment, we offer deposits, mortgage-backed housing loans, retail loans against property (Retail LAP), auto loans, cards and payments, non-resident banking, and wealth management services. Our business banking segment primarily provides business loans to Micro, Small and Medium Enterprises (MSMEs). Whereas our CV/CE segment finances the purchase of new and used Commercial Vehicles and Construction Equipment for single-unit owners, fleet operators, and strategic clients. Additionally, our agri-banking segment provides financing solutions for agriculture and the priority sector.

Retail Banking Dashboard

18%

₹ 95,791 Crore

Retail Credit Book

17%

₹ 56,077 Crore

Retail Advances

71%

₹ 2186 Crore

CV/CE Advances

21%

₹ 23,355 Crore

Agri Advances (Including MFI)

13%

₹ 14,173 Crore

Business Banking Advances

15%

₹ 19,841 Crore

Gold Loan

27%

₹ 16,242 Crore

Debit card spends

85%

CASA + Deposits <=2 Crore (% of Total Deposits)

: Y-o-Y Growth/Degrowth

Key Focus Areas

Retail banking maintains its focus on credit cards and personal loans as the primary drivers of its higher-margin portfolio. There has been a notable increase in the sales of these products, in both organic and FinTech channels, indicating a growing interest in these products.

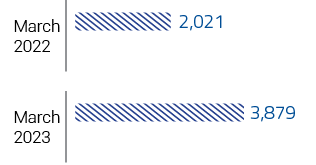

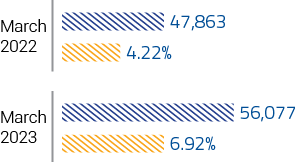

To provide more information on the performance of personal loans and credit cards in relation to core retail advances and total retail assets, the following figures for FY 2021-22 and FY 2022-23 are presented:

Proportion of CCPL

The figures presented clearly illustrate the growing contribution of credit cards and personal loans to the overall portfolio of retail banking, thus highlighting the growth potential of these products in the future.

Achievements of Retail Banking

Data & Analytics

At Federal Bank, we believe that data is essential to our success in the retail industry. To this end, our analytics team implements various initiatives aimed at enriching our data. These initiatives have proven highly beneficial to our Company in multiple ways, including improvements in cross-sell ratios, increased debit card spending, and enhanced insurance penetration.

Digitalisation

In the past year, we have made a concerted effort to prioritise digitalisation as a key strategic initiative. As a result of our focussed efforts, an impressive 90% of our transactions are now conducted through digital channels. Our progress in this area is further demonstrated by the significant improvements made to our chatbot, Feddy, which can now effortlessly handle on an average over 5,000 queries per day.

Deep Relationship with Customers

Launched industry-leading Cx Customer Relationship Management System, in collaboration with Oracle and Infosys, which has given us a significant edge over competitors. Cx system has enhanced our understanding of customers’ needs and helped us to cater to them better, strengthening our position in the market.

Introduced new products such as Personal Loans via Paisabazaar and implemented cross-selling strategies to existing customers. These include offering credit cards to Jupiter and Epifi customers, and Personal Loans to One Card customers, among others.

Distribution

Our commitment to expanding our market presence is demonstrated by several initiatives. These include the following:

Added 75 new branches during FY 2023, which has pushed us beyond the 200-branch milestone in the Chennai Zone.

Opened a Digital Banking Unit (DBU) in the District of North 24 Parganas, West Bengal as part of Azadi Ka Amrit Mahotsav to provide various Digital Banking Services to the public.

Implemented various alternative distribution channels, such as co-lending and increasing the number of Relationship Managers, in addition to traditional branches to cater to the diverse needs of our customers.

Launched our unique ‘BankOnTheGo’ initiative, where a bus equipped with state-of-the-art technology travels across the city to provide banking services to customers. This service has been successfully launched in Madurai and Lucknow.

Collaborated with FinTechs to expand our reach in the market. We have established partnerships with over 75 partners and developed more than 400 APIs to enable these collaborations. We believe in co-working with FinTechs rather than competing with them.

Retail Growth Strategy

Our Retail Banking business holds a formidable position, well-poised to significantly increase its contribution towards the overall growth of our Bank. Moving ahead, our primary objective will be to optimise deposit generation, with a specific focus on acquiring low-cost Current Account and Savings Account (CASA) deposits. Additionally, we will strategically prioritise high-margin assets like credit cards and personal loans, while simultaneously aiming to boost our fee-based income.

Our wholesale banking segment comprises Commercial Banking (CoB), Corporate and Institutional Banking (CIB) and Government & Institutional Business (GIB). CoB provides a comprehensive financing solution to mid-market and MSMEs, while CIB caters to large business houses and corporates, MNCs, capital market clients, PSUs and financial institutions. GIB caters to the Government departments and various Government institutions, largely focussing on liability business.

Our wholesale banking segment offers an extensive array of solutions tailored to meet the diverse needs of our esteemed clientele. These incorporate a comprehensive suite of offerings, including working capital loans, term loans, trade finance, cash management, supply chain finance, foreign exchange services, treasury products, structured offerings, gold metal loans, liability products and digital solutions.

Wholesale Banking Dashboard

18%

₹ 17,274 Crore

Commercial Banking Advances

23%

₹ 64,311 Crore

Corporate Banking Advances

214

New Clients Added in Corporate Banking

334

New Clients Added in Commercial Banking

105%

₹ 3,255 Crore

SCF Business

25%

₹ 397 Crore

Fee Income

Achievements of Wholesale Banking

Data & Analytics

Data-driven insights have played a pivotal role in propelling the growth of Federal Bank. By harnessing vast amount of data, we have identified the most promising areas for growth and effectively targetted the right customers. This strategic approach has facilitated substantial expansion of our customer base. Moreover, leveraging data has allowed us to optimise both client and product profitability and have enabled us to closely monitor credit levels and mitigate risks effectively.

Digitalisation

At Federal Bank, we are swiftly propelling our digital transformation, harnessing our strong digital capabilities. Our Bank has taken significant strides towards a paperless environment by embracing digitised Escrow account solutions and commercial paper issuance. Furthermore, we have commenced with the Trade Finance Digitalisation Project, which is a step forward towards upgrading our digital capabilities allowing for reduced transaction time, while ensuring compliance with regulatory guidelines in an efficient manner. This empowers us to elevate our offerings within the wholesale banking space.

Distribution

During FY 2022-23, Federal Bank successfully onboarded 548 new clients spanning various sectors and geographies. Moving ahead, we are keen on exploring opportunities in some identified sectors such as hospitality, education, healthcare and green asset funding. Additionally, we aim to attract reciprocal businesses, such as trade, treasury, and transaction products that provide the opportunity to be a major banking partner to our clientele and increase the overall returns of the organisation.

Wholesale Growth Strategy

At Federal Bank, wholesale banking remains a prime driver of our growth trajectory. Some of the key strategic initiatives undertaken by the wholesale banking division are as mentioned below:

Established strategic partnerships with major corporates/OEMs for funding their ecosystem.

Collaborated with TReDS exchanges to facilitate efficient factoring of invoices for large corporates.

Forged key alliances with FinTech companies, enabling seamless end-to-end digital transaction sourcing and processing.

At Federal Bank, we have set our sights on expanding our mid-market client base and nurturing stronger relationships with our valued clients. Our strategic approach focusses on increasing the range of products available to each customer and positioning ourselves as their trusted banking partner. Additionally, we remain committed to achieving meaningful self-funding and Priority Sector Lending (PSL) self-sufficiency within the wholesale vertical.