Healthy Growth

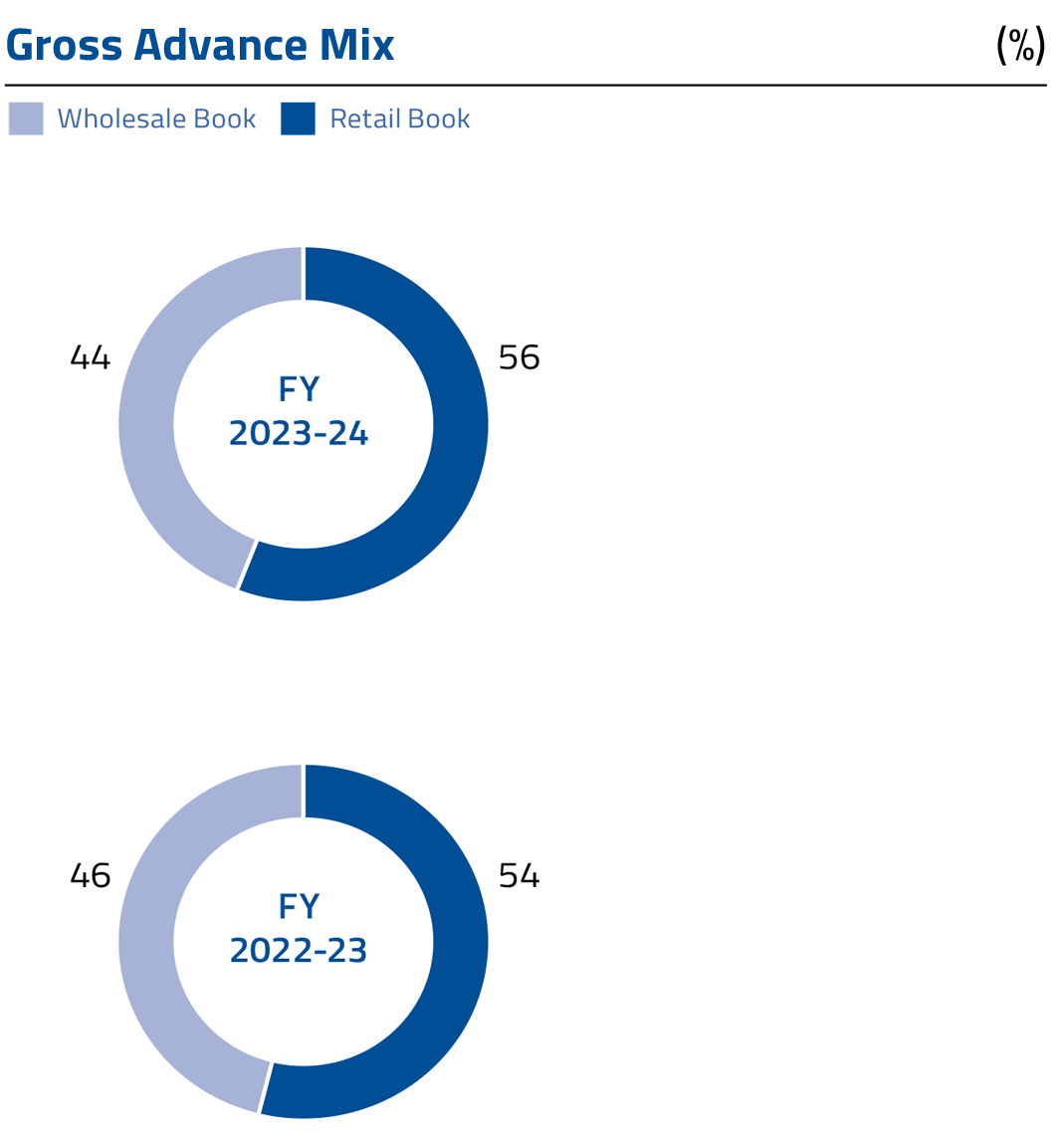

and retail clients, ensuring a seamless banking experience. We aim for stable and

diversified loan growth across businesses.

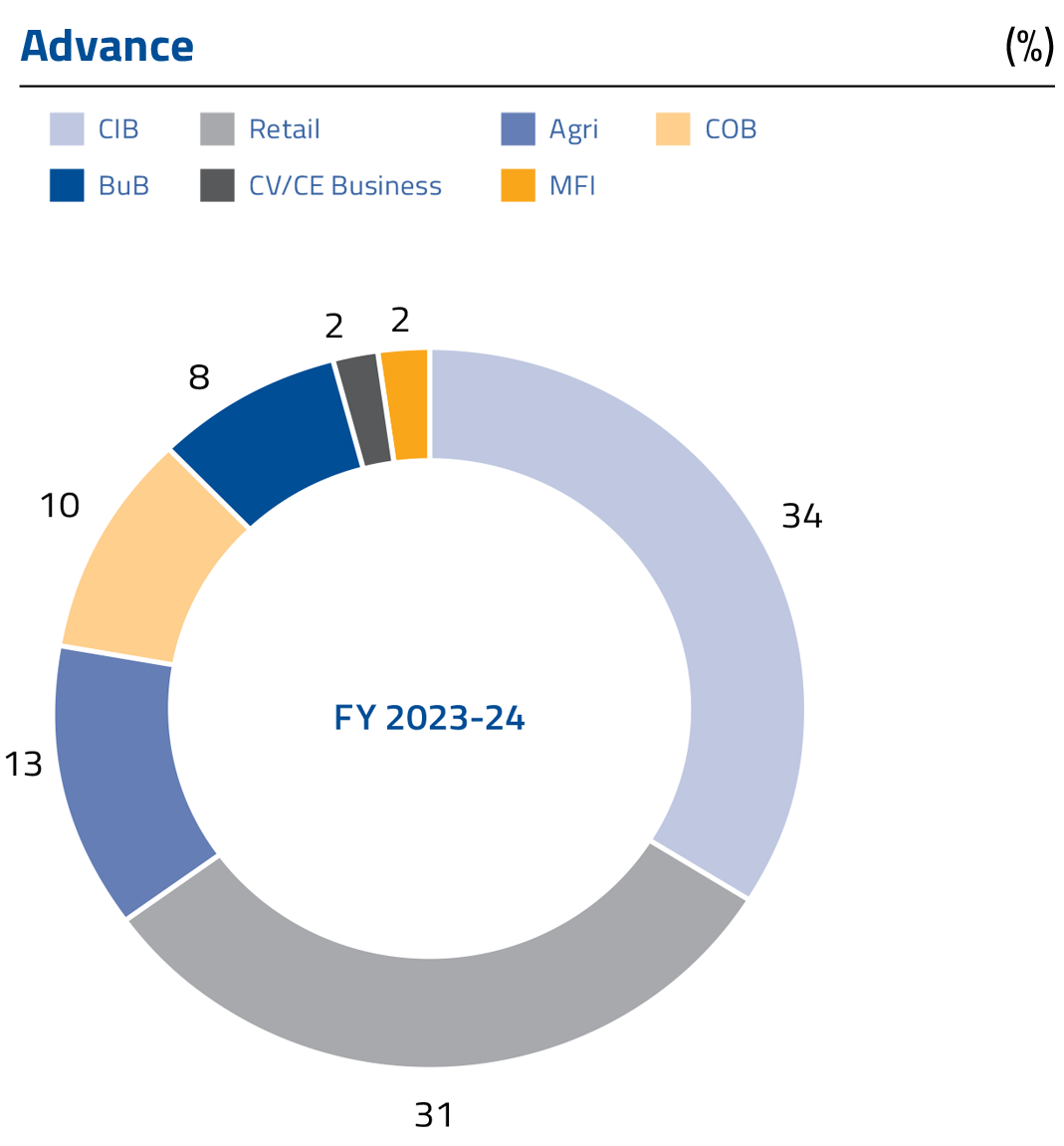

* Agri: Agri Loans, BuB: Business Banking, CV/CE: Commercial

Vehicles, Construction and Equipment Finance,

MFI: Micro finance institutions, CoB: Commercial Banking, CIB: Corporate

and

Institutional

Banking

* CoB and CIB are wholesale banking and others are a part of retail banking

Credit segments are realigned at the beginning of every FY. Vertical-wise

advance figures do

not account for sale via IBPC

RETAIL BANKING DIVISION

Our Retail Banking business consists of Retail Banking, CV/CE Financing, Agri-banking and Business Banking, Gold Loans and Microfinance.

- Retail Banking: Deposits, mortgage-backed housing loans, retail loans against property (Retail LAP), auto loans, cards and payments, non-resident banking, and wealth management services.

- Business Banking: Business loans to Micro, Small and Medium Enterprises (MSMEs).

- CV/CE Financing: Purchase of new and used commercial vehicles and construction equipment for single-unit owners, fleet operators, and strategic clients.

- Agri Banking: Financing solutions for agriculture and the priority sector.

- Gold Loans: The Bank uses innovative products to offer loans against gold.

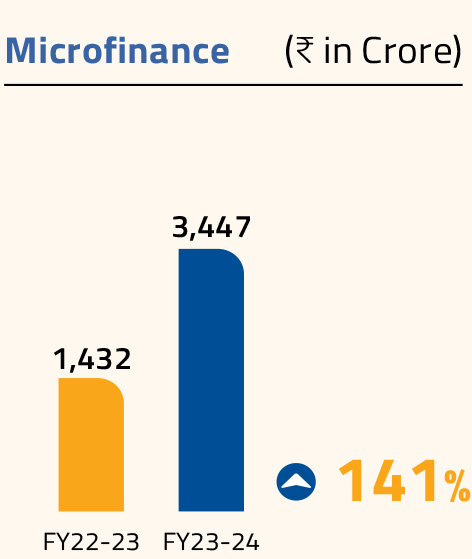

- Microfinance: Financing solutions for improving and promoting inclusive growth.

` 1,0 Crore

Retail credit book as on March 31, 2024

` 0,0 Crore

Total Deposits as on March 31, 2024

Key Focus Areas

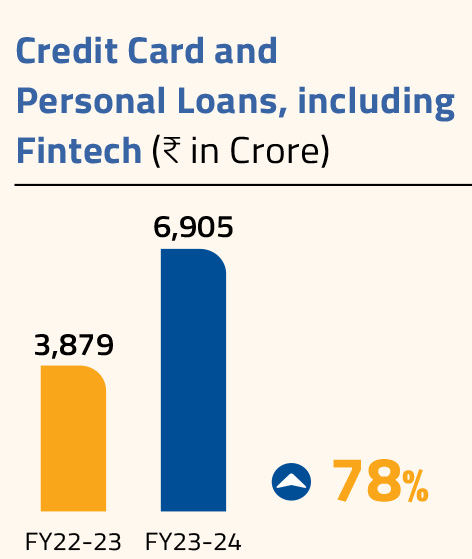

- Focus on building high-margin businesses like microfinance, credit cards and personal loans within our Bank’s risk appetite.

- Leveraging analytics and tailoring more products and services to specific customer segments, ultimately redefining the customer experience.

- Continuation of branch network expansion, targeting unexplored locations.

- Acquisition of more low-cost funds by effectively leveraging our strengthened Relationship Manager force.

Retail Banking provides a key focus on high-margin lending products like credit cards, personal loans, and microfinance.

WHOLESALE BANKING DIVISION

Our Wholesale Banking segment comprises Commercial Banking (CoB), Corporate and Institutional Banking (CIB) and Government & Institutional Business (GIB). Our Wholesale Banking solutions are part of a comprehensive suite of offerings, including working capital loans, term loans, trade finance, cash management, supply chain finance, foreign exchange services, treasury products, structured offerings, gold metal loans, liability products and digital solutions.

- CoB: This segment provides comprehensive financing solutions to mid-market and MSMEs.

- CIB: This segment caters to large business houses and corporates, MNCs, capital market clients, PSUs and financial institutions.

- GIB: Caters to Central and State government departments and various government institutions, largely focusing on the liability business.

0 Crore

Wholesale Banking Advances as on March 31, 2024

Vertical wise advance figures do not account for sale via IBPC.

Key Focus Areas

- Supply chain finance: Capture corporate ecosystem, PSL portfolio, higher yield, granular book.

- Deeper geography: Higher yield, granular book, minimise geographical risk, high PPC.

- Wholesale liability: Improve CASA & self-funding, promoters/KMP relationship, high PPC.

- Syndication Desk to originate and downsell large ticket loans.

- Digitalisation: Launching a more advanced version of the Corporate Digital platform.